Keep calm during turbulent markets and replicate directors’ dealings

August 7, 2024

Stock markets go up and down. On August 5, 2024, the Japanese stock market index Nikkei saw the biggest daily decline in 37 years.1 On the following day, August 6, 2024, the Nikkei rose again to mark its largest ever daily gain.2 Such market turbulence can be scary – especially for retail investors. So, the question arises whether replicating directors’ dealings can help to keep calm during turbulent markets and yield consistent investment returns.

Replicating directors’ dealings of top CFOs yields consistent investment returns across years

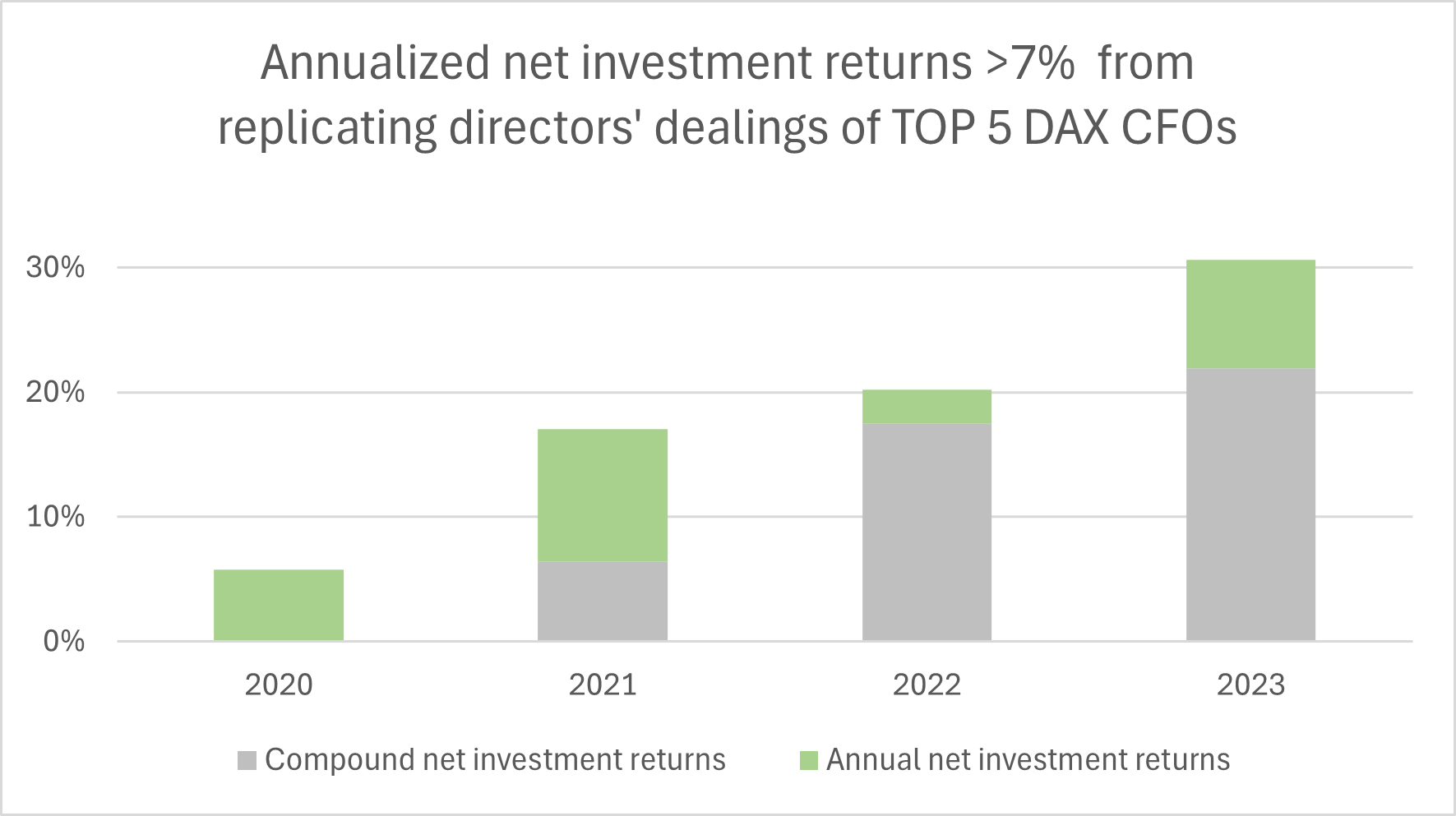

A previous blog post indicated that replicating the managers’ transactions of CFOs can be advantageous over those of other executives. Therefore, BOSS STOCKS ran a simulation to investigate how replicating the directors’ dealings of the top 5 CFOs in the DAX from the previous year played out in the following year with an initial investment of 1,000 EUR between 2020 and 2023.3

- It’s January 1, 2020. 1,000 EUR are ready for investment by replicating the directors’ dealings of the top 5 DAX CFOs. However, not even three months later, following the emergence of COVID-19 the markets sharply declined and then rebounded. It is not until May that the top CFOs of 2019 start to engage in managers’ transactions. Replicating the five directors’ dealings between May and December 2020 generated a net investment return of nearly 6%.

- 2021 turned out to be a good year for investing in stocks. The top DAX CFOs of 2020 executed two managers’ transactions between March and June 2021. Replicating them yielded a net investment return of almost 11%.

- In contrast, 2022 was a difficult year in the stock market with negative performances of many stocks. However, replicating the two directors’ dealings of the top DAX CFOs of 2021 generated a net investment return of nearly 3%.

- In 2023, most stocks rose again and replicating the two managers’ transactions of the top DAX CFOs of 2022 yielded a net investment return of almost 9%.

- In total, investing 1,000 EUR at the beginning of 2020 led to a net amount of 1,306 EUR at the end of 2023. This is a net investment return after tax of >30% over four years or >7% annualized in which every year contributed with positive returns irrespective of market turbulence.

BOSS STOCKS helps you find the “right executives” and their directors’ dealings

The simulation illustrates that replicating directors’ dealings enables you to keep calm during turbulent markets because it allows you to yield consistent investment returns across years. BOSS STOCKS helps you identify the right executives to replicate their directors’ dealings. Free sign up to test the product before market launch.

- Banerjee & Fujita (2024) ↩︎

- Riley (2024) ↩︎

- Selection of CFOs is based on performance of directors’ dealings in the previous year, no parallel investments, returns are re-invested after deduction of 25% capital income tax (i.e., net investment returns) ↩︎