The US presidential election’s effect on the performance of directors’ dealings in Germany

October 16, 2024

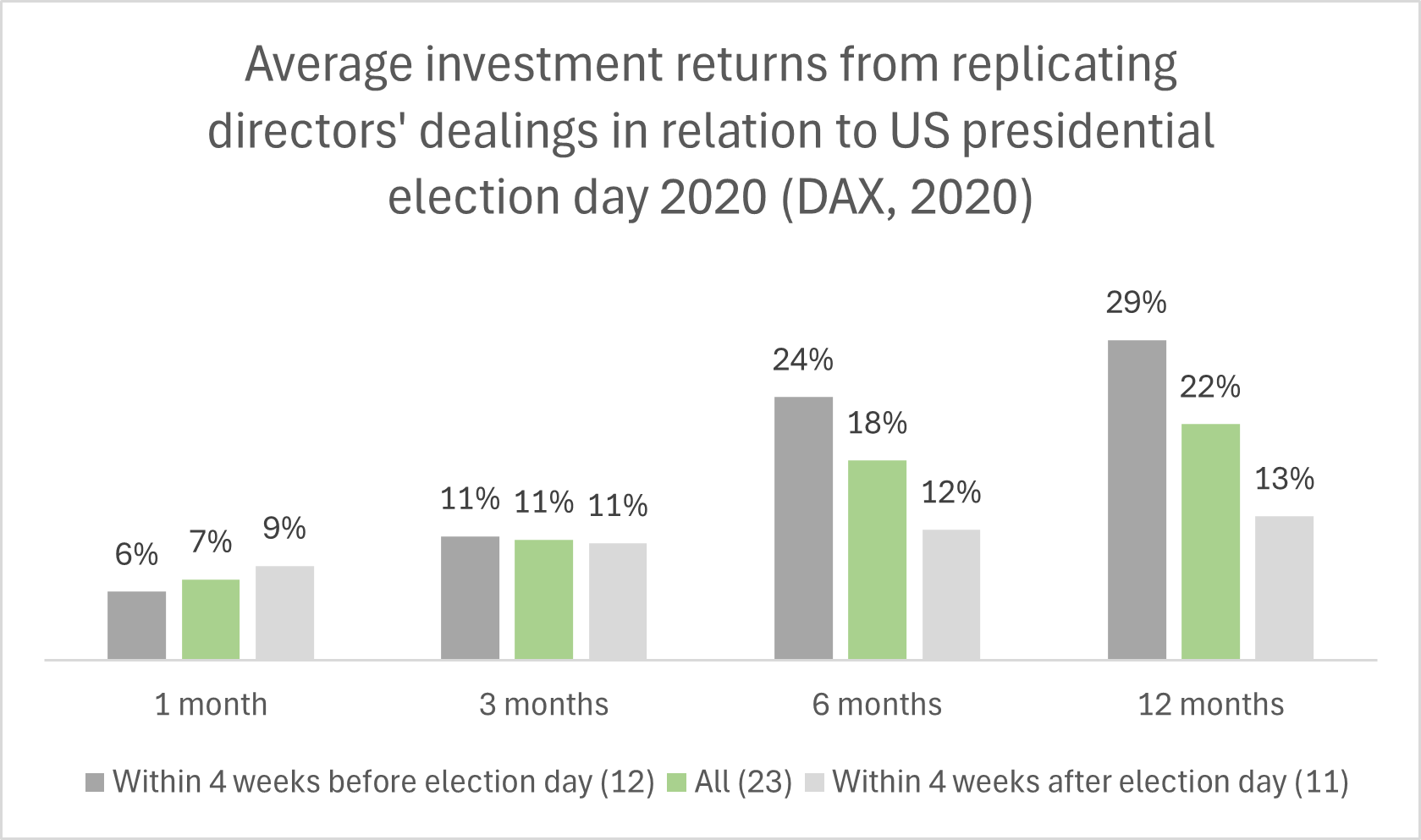

The US state of Georgia has just opened early voting for the November 5, 2024 US presidential election with nearly double the turnout of voters compared to four years ago.1 Historically, the US S&P500 stock index has continued an upward trend with an average return of 8% in the post-election year.2 This provokes the question: How do US presidential elections affect the performance of directors’ dealings in Germany? BOSS STOCKS analyzed 23 directors’ dealings (stock acquisitions) in the German DAX which took place within four weeks prior and four weeks after the last US presidential election day on November 3, 2020.

The 2020 US presidential elections were positively linked with replication performance of directors’ dealings in Germany

- The results indicate that replicating directors’ dealings was successful even with a simple strategy. Buying stocks for the opening share price of the day that follows the day of the release and holding for 1 month/3 months/6 months/1 year led to average investment returns of 7%/11%/18%/22%.

- The directors’ dealings prior to the election day exhibit superior investment returns compared to those post the election day. Moreover, all of the managers’ transactions prior to the last US presidential election showed positive investment returns after 3/6/12 months.

- The 23 directors’ dealings spread over 7 companies. Around 2/3 of the transactions relate to two companies: SAP (10) and Munich Re (5).

- The 23 directors’ dealings spread over 18 executives . The top 3 performers with a return of at least 34%/year included Hasso Plattner, Heike Steck and Dr. Juergen Mueller, all of SAP.

Discover the directors’ dealings for strong investment returns with BOSS STOCKS

The results confirm that the last US presidential elections were followed by a positive performance of directors’ dealings in Germany. BOSS STOCKS helps you replicate such directors’ dealings. Free sign up to test the product before market launch.