Collective intelligence and investment returns: Cluster vs. individual directors’ dealings

August 2, 2024

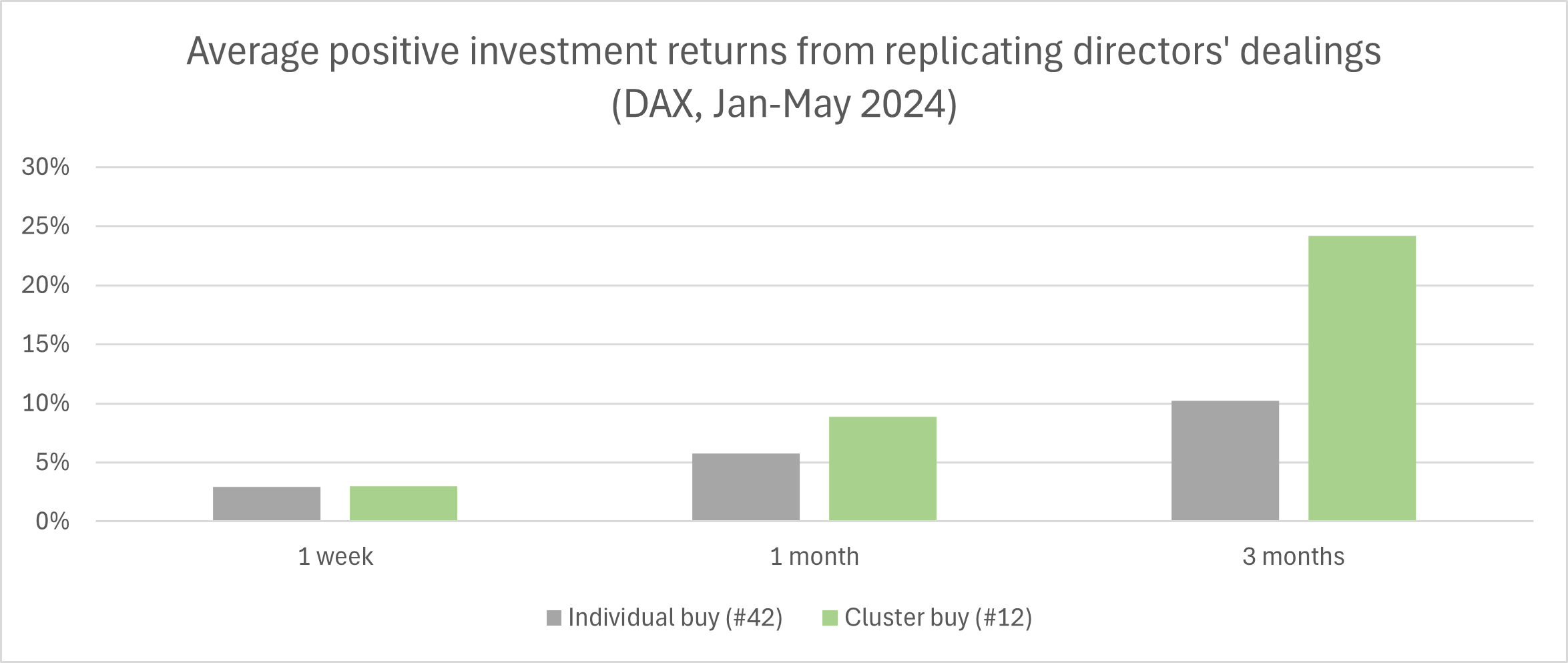

A previous blog post assessed the differences between investment returns and executive roles. We have also observed that multiple executives deal on the same day. For example, on August 1, 2024, two board members at Heidelberg Materials bought shares. This can be referred to as a “cluster buy” and is regarded as a strong trading signal.1 So, how do investment returns compare when replicating cluster vs. individual directors’ dealings? BOSS STOCKS examined the average positive investment returns between one week and three months from replicating 54 directors’ dealings (stock acquisitions) in the German DAX between January and May 2024.

Collective intelligence outperforms the individual on investment returns with directors’ dealings

The data suggests that the average positive investment return from replicating directors’ dealings is greater for cluster vs. individual buys. While the results are similar within one week, the spread increases for periods of one and three months. Within one month, the cluster buys yielded investment returns of nearly 9%, which is 50% greater than the individual acquisitions. Within three months, the cluster buys generated investment returns of nearly 25% which is more than double compared with the individual acquisitions.

Examples of investment returns based on cluster and individual directors’ dealings

- Rheinmetall accounted for a third of the cluster buys. Replicating these directors’ dealings yielded average positive investment returns of 5%/20%/60% within 1 week/1 month/3 months.

- BASF’s executives engaged in cluster and individual buys. The replication of one of the individual transactions of the current CEO, Dr. Markus Kamieth, yielded superior investment returns of 5%/16% in 1 week/1 month.

- The highest investment return of 37% within three months related to the replication of a stock acquisition of Commerzbank’s CFO, Dr. Bettina Orlopp.

Discover the directors’ dealings for superior investment returns with BOSS STOCKS

The results show that replicating managers’ transactions related to cluster buys yield – on average – superior investment returns. However, individual buys can also signal a stocks’ future performance. BOSS STOCKS helps you replicate such directors’ dealings. Free sign up to discover the directors’ dealings that can help you yield superior investment returns.