ECB’s interest rate reductions positively affect replication performance of directors’ dealings in Germany

October 30, 2023

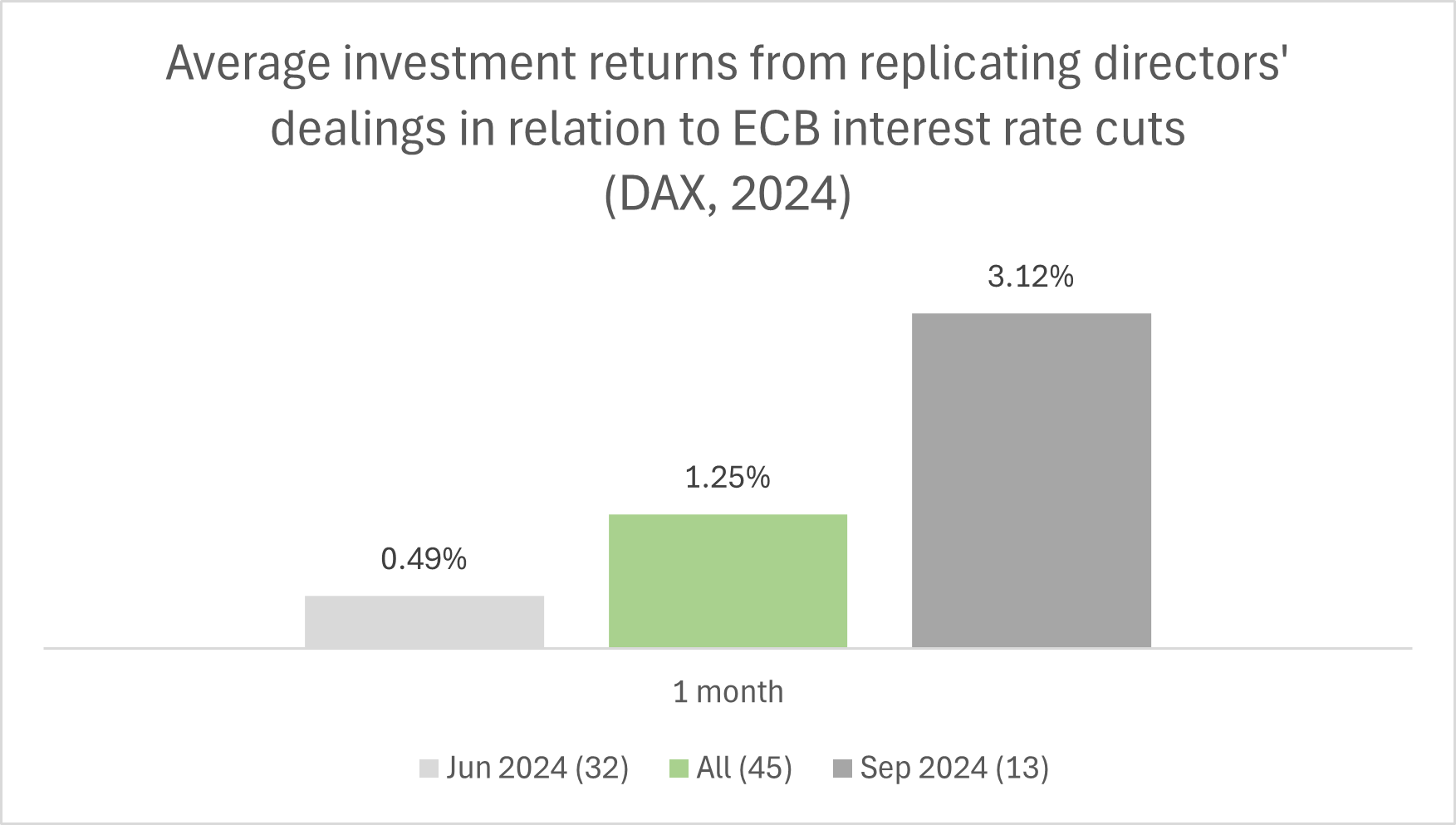

Today marks the 100th anniversary of World Savings Day. Many have learned the importance of saving money with a piggy bank but decreasing interest rates make investing more attractive. A previous blog post showed that the US Federal Reserve’s interest rate cuts influenced the performance of directors’ dealings in Germany in 2019-2020. In 2024, the European Central Bank (ECB) has lowered the interest rates three times by 0.25%.1 Further discussions have started whether the ECB might go for a larger cut of 0.50% in anticipation of the next ECB meeting in December.2 This leads to the question: How did ECB’s recent interest rate reductions affect the performance of directors’ dealings in Germany? BOSS STOCKS analyzed 45 directors’ dealings (stock acquisitions) in the German DAX which were published within two weeks after the announcement of the of the ECB’s interest rate cuts in June and September 2024.

ECB’s interest rate reductions positively influence replication performance of directors’ dealings in Germany

- The results show that replicating directors’ dealings is successful even with a simple strategy. This is, buying stocks for the opening share price of the day that follows the day of the release and holding for one month. As a result, this led to average investment returns of +1%/month.

- Notably, the performance was substantially higher for managers’ transactions following the interest rate cuts in September 2024 (+2 p.p.). This is in line with the positive market trend.

- 26 companies are associated with the 45 directors’ dealings. However, there are only four companies with three or more directors’ dealings. Rheinmetall (5), Douglas (4), Hensoldt (3) and LEG Immobilien (3).

- 30+ individuals are associated with the 45 directors’ dealings. The top performers with a return north of 10%/month include Daniel Grieder, CEO at Hugo Boss and Manfred Piontke, Member of the Supervisory Board at grenke.

Discover the directors’ dealings for strong investment returns with BOSS STOCKS

The results suggest that the ECB’s interest rate reductions drive the performance of directors’ dealings in Germany. BOSS STOCKS helps you replicate such directors’ dealings. Free sign up to test the product before market launch.