A global world – US interest rate cuts drive replication performance of directors’ dealings in Germany

September 18, 2024

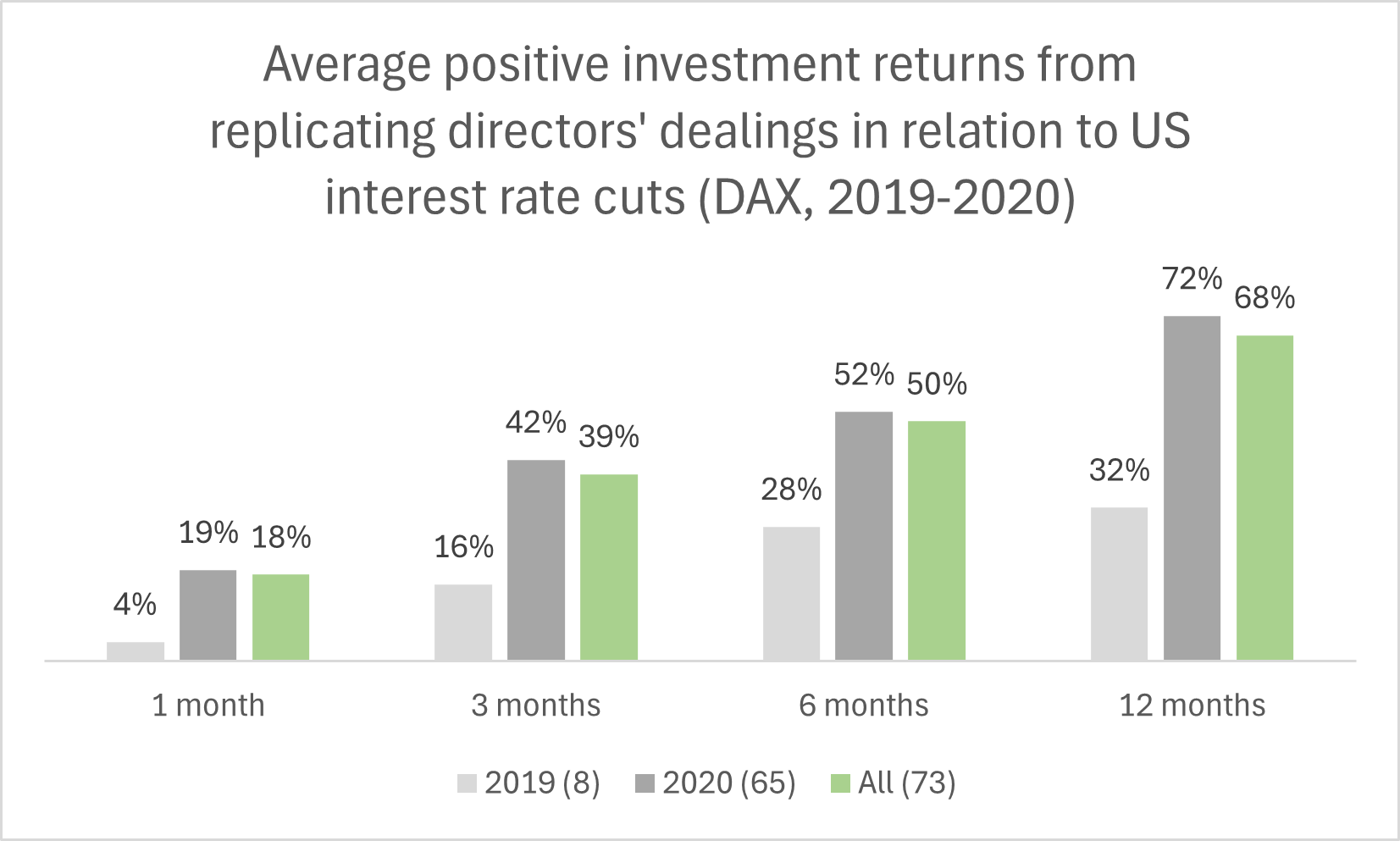

The US Federal Reserve (Fed) is due to announce its first interest rate cut in four years.1 Decreasing interest rates typically drive stock markets up because the borrowing costs fall and it becomes cheaper to grow the businesses and boost earnings.2 Since the US Dollar is the world’s most traded currency easing liquidity will affect businesses in the United States and beyond. This leads to the question: How do the Fed’s interest rate cuts affect the replication performance of directors’ dealings in Germany? BOSS STOCKS analyzed 73 managers’ transactions (stock acquisitions) in the German DAX which took place within two weeks after the announcement of the last five of the Fed’s interest rate cuts between October 2019 and March 2020.

US interest rate cuts positively influence replication performance of directors’ dealings in Germany

- Replicating directors’ dealings led to average positive investment returns of up to 19%/42%/52%/72% within one/three/six/twelve months. Notably, the performance was substantially higher for managers’ transactions in the aftermath of the interest rate cuts in March 2020. This went hand-in-hand with the stock market recovery from the COVID-19 shock.

- 15 companies were associated with the 73 directors’ dealings. More than 2/3 of the transactions related to four companies: Fresenius, Heidelberg Materials, RWE and DHL Group.

- 38 executives were associated with the 73 directors’ dealings. The top 3 performers with a return north of 140% within one year included Dr. Jürgen Hambrecht, Member of the Supervisory Board at Mercedes-Benz, Dr. Thomas Ogilvie, Member of the Board of Management at DHL Group and Chris Ward, Member of the Managing Board at Heidelberg Materials.

Discover the directors’ dealings for strong investment returns with BOSS STOCKS

The results confirm that the Fed’s interest rate cuts drive the performance of directors’ dealings in Germany. BOSS STOCKS helps you replicate such directors’ dealings. Free sign up to test the product before market launch.