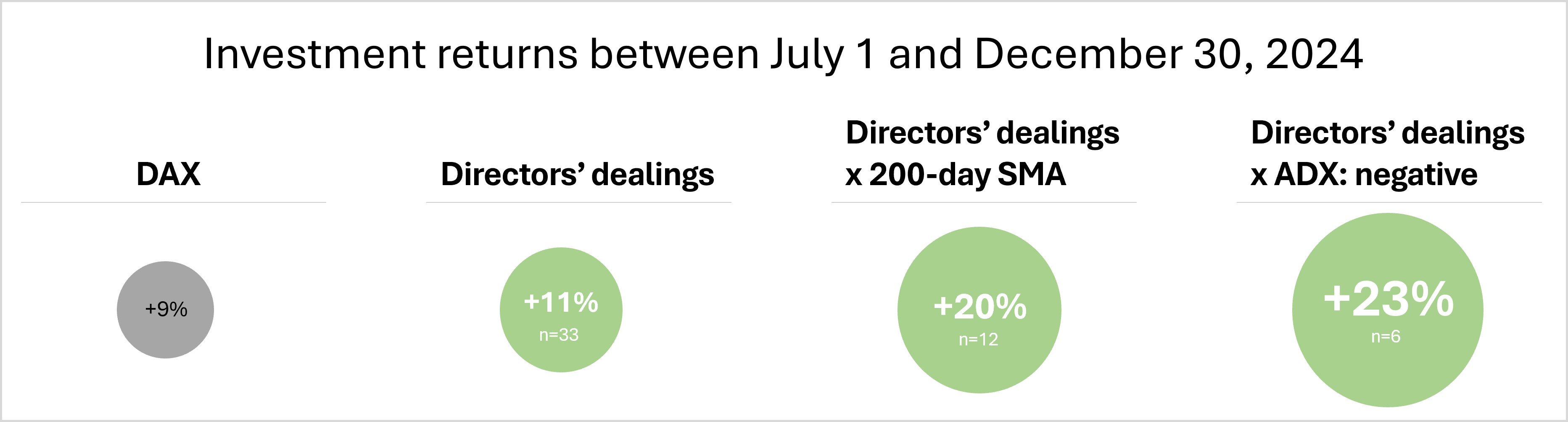

2024 in review: Directors’ dealings exceeded index performance

January 2, 2025

2024 was a good year at the stock market with positive returns across many indexes and countries. The change of years seems a good time to take stock and review how managers’ transactions held up against the index performance of the German DAX… Read more

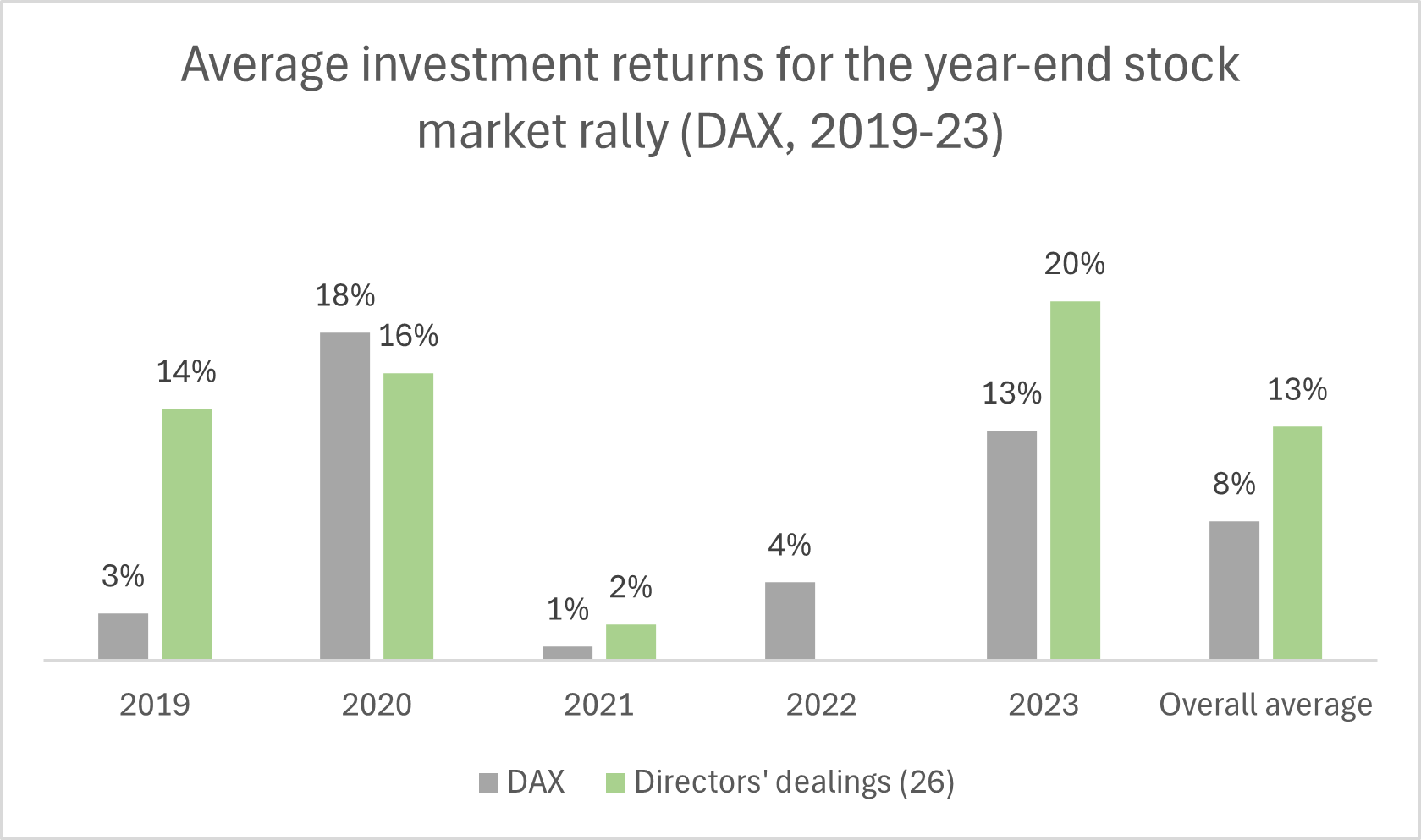

Will we see a year-end rally in the stock market, again?

November 13, 2024

Comes November, sometimes already in October, the year-end rally in the stock market grows into a hot topic. Naturally, this provokes the question: Was there a year-end rally in the German DAX in recent years and how did directors’ dealings perform in this context?… Read more

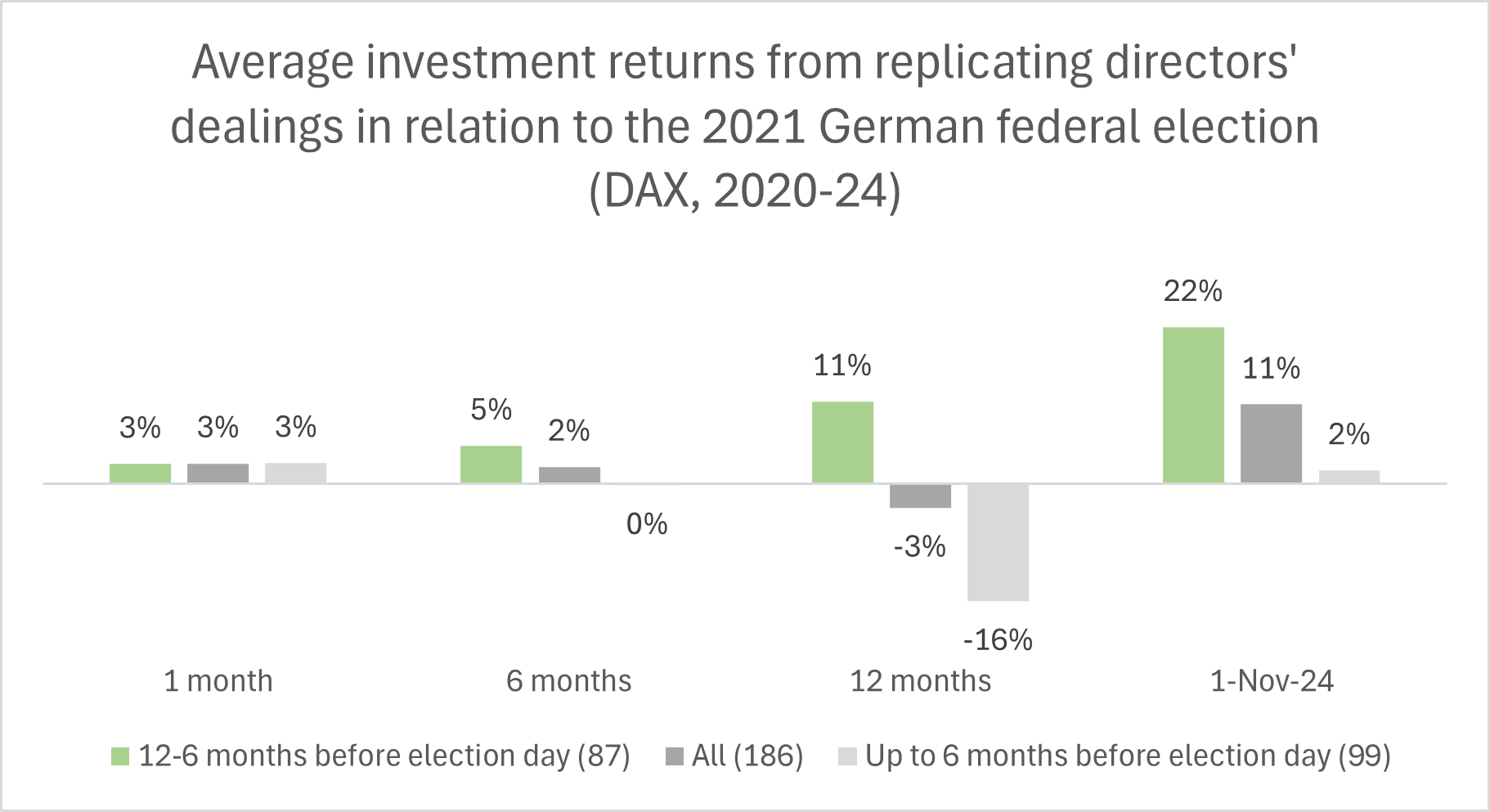

Performance of directors’ dealings in relation to German federal election

November 5, 2024

Today is election day for the 2024 US presidential election. The next German federal election is less than 11 months ahead. Hence, investors may wonder: What is the performance of directors’ dealings in the year prior to a German federal election?… Read more

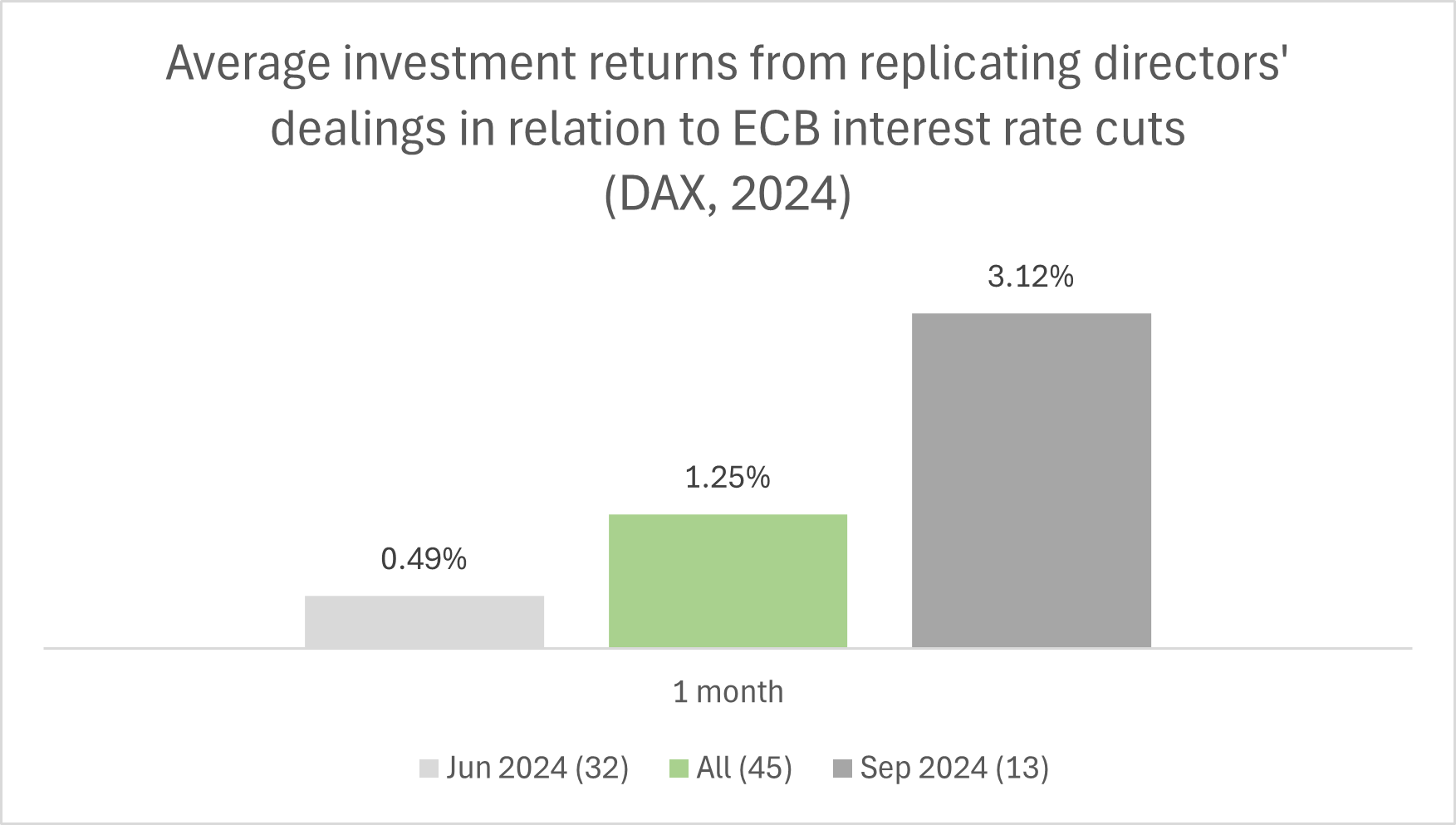

ECB’s interest rate reductions positively affect replication performance of directors’ dealings in Germany

October 30, 2024

Today marks the 100th anniversary of World Savings Day. Many have learned the importance of saving money with a piggy bank but decreasing interest rates make investing more attractive. Naturally, this makes one think: How did ECB’s recent interest rate reductions affect the performance of directors’ dealings in Germany?…. Read more

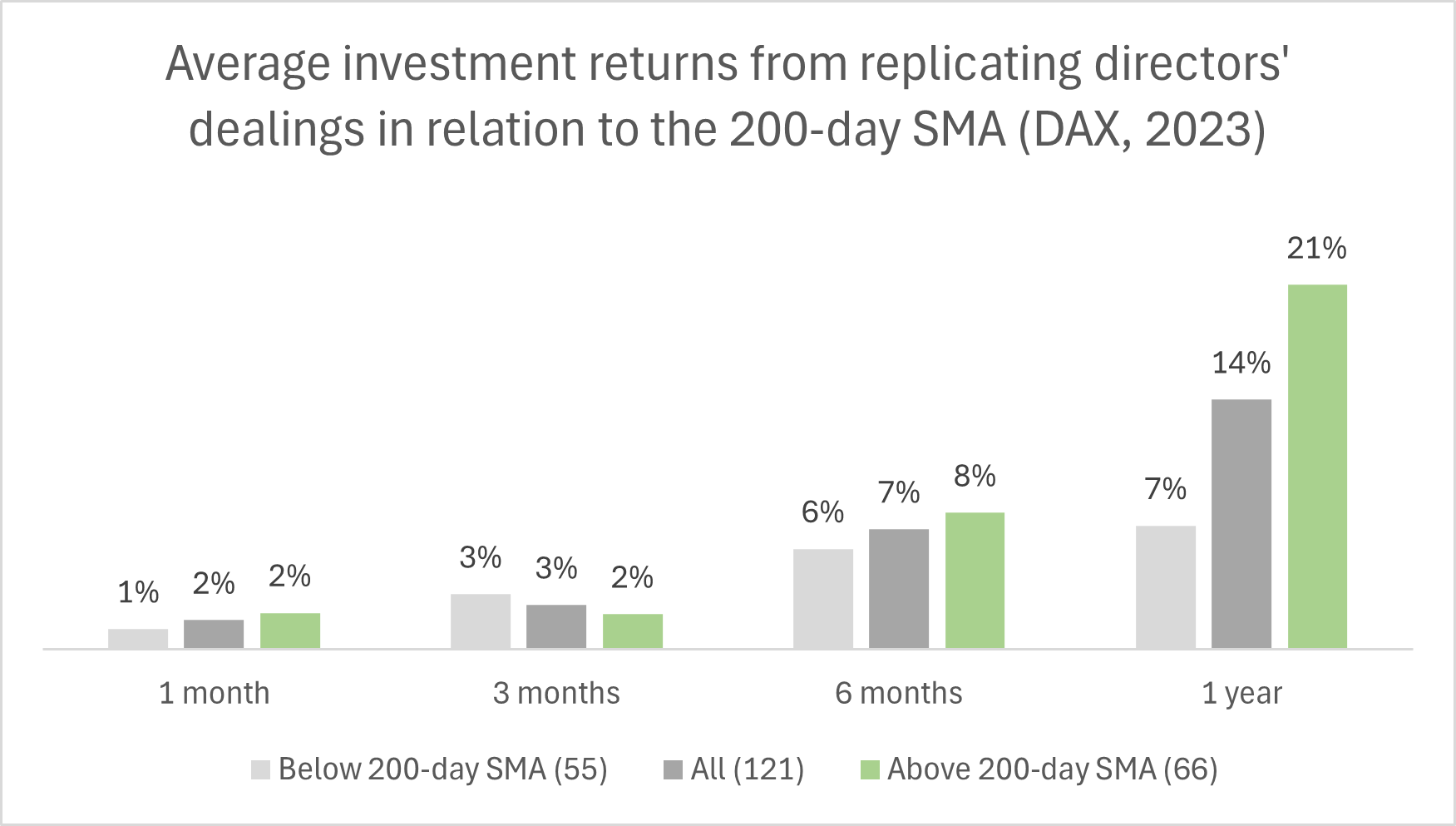

Directors’ dealings and the 200-day simple moving average

October 23, 2024

The 200-day simple moving average (SMA) is used to evaluate long-term market trends and the stock price above/below is considered a positive/negative signal. This leads to the question: Can the combination of directors’ dealings with the 200-day SMA improve replication performance in the longer term?…. Read more

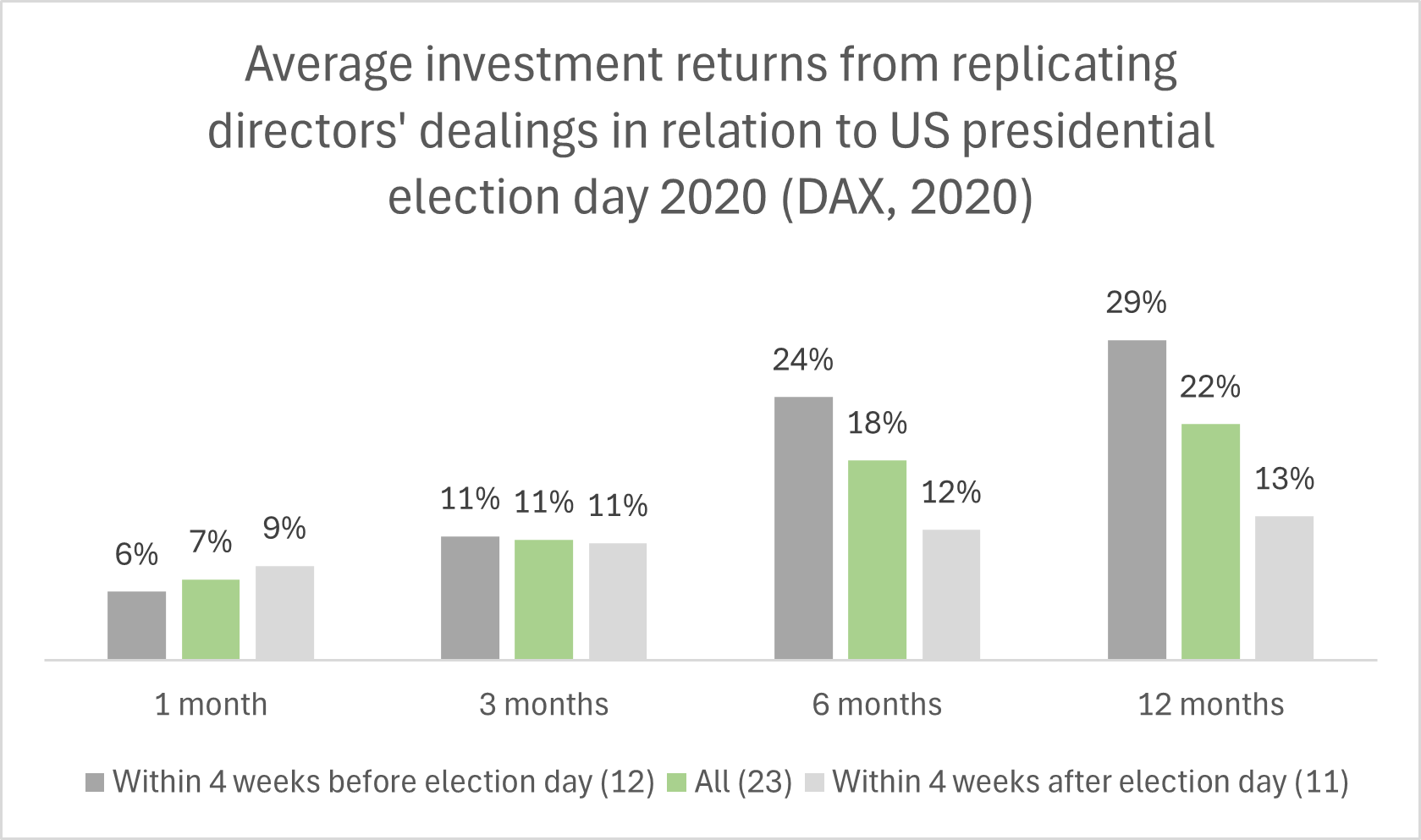

The US presidential election’s effect on the performance of directors’ dealings in Germany

October 16, 2024

The US state of Georgia has just opened early voting for the November 5, 2024 US presidential election. Historically, US stock markets have followed a positive trend post election. Naturally, this makes one think: How do US presidential elections affect the performance of directors’ dealings in Germany?…. Read more

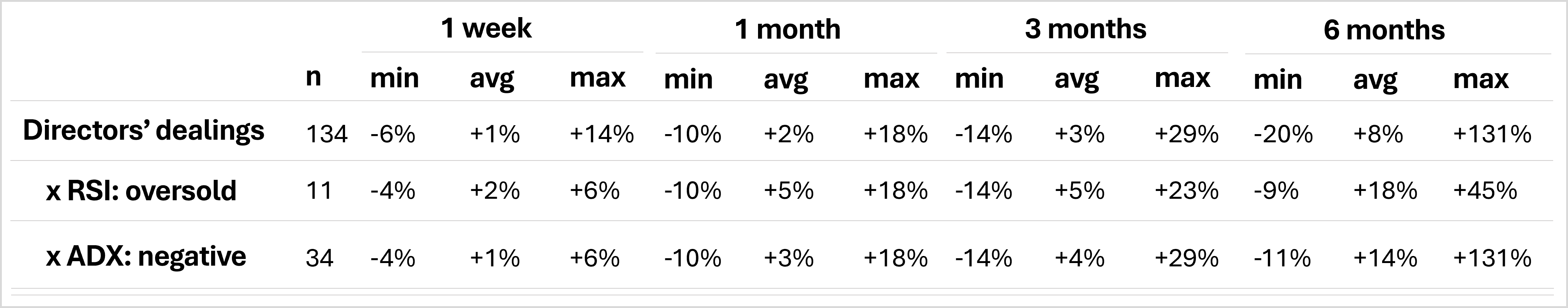

Mix and match – Combining directors’ dealings and technical analysis indicators

October 10, 2024

Market timing is to predict developments and to move investments accordingly. Investors use trading signals and technical analysis indicators to predict stock developments. This leads to the question: Can the combination of directors’ dealings with technical analysis indicators improve replication performance?… Read more

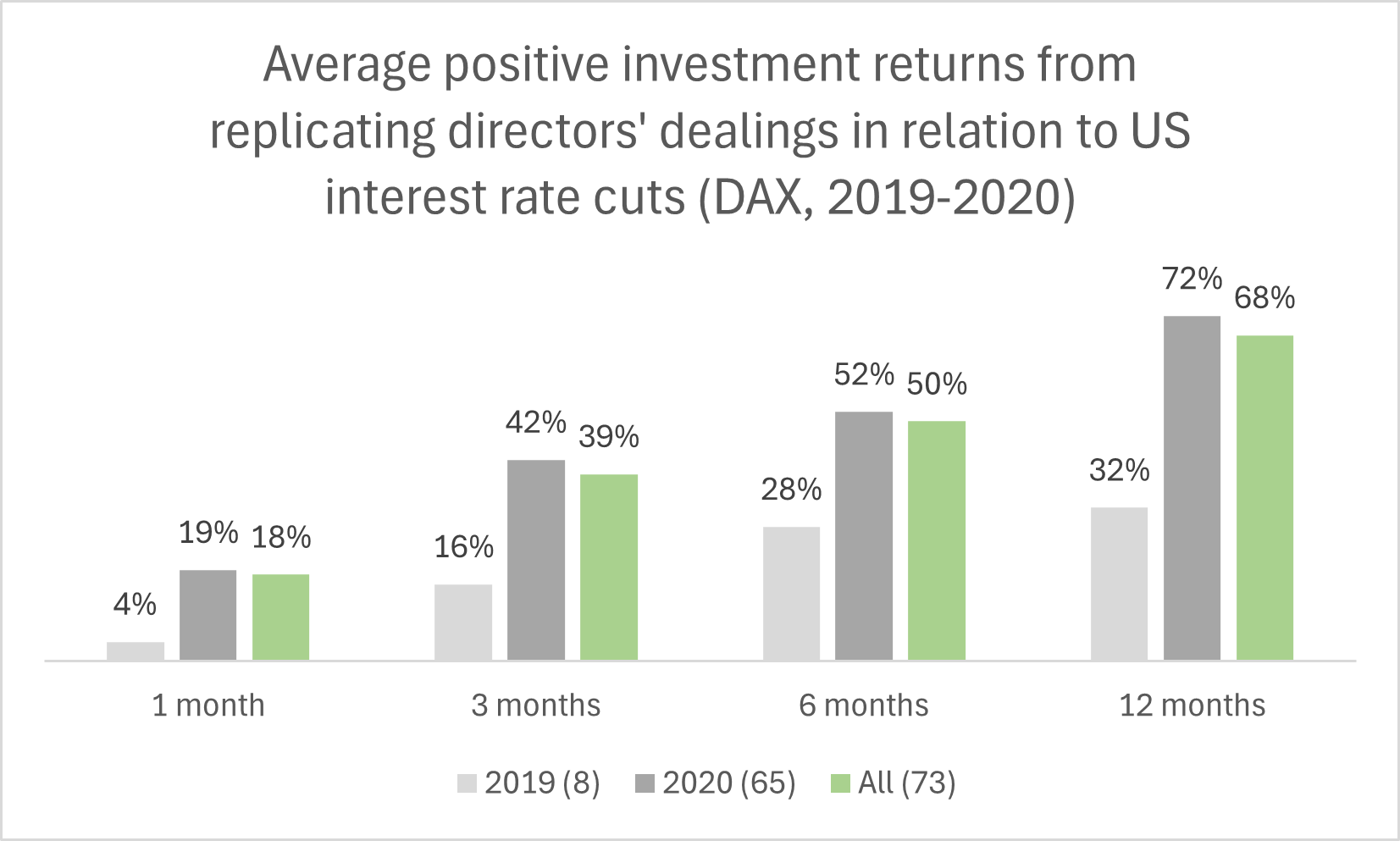

A global world – US interest rate cuts drive replication performance of directors’ dealings in Germany

September 18, 2024

The US Federal Reserve (Fed) is due to announce its first interest rate cut in four years. Decreasing interest rates typically drive stock markets up. This leads to the question: How do the Fed’s interest rate cuts affect the replication performance of directors’ dealings in Germany?… Read more

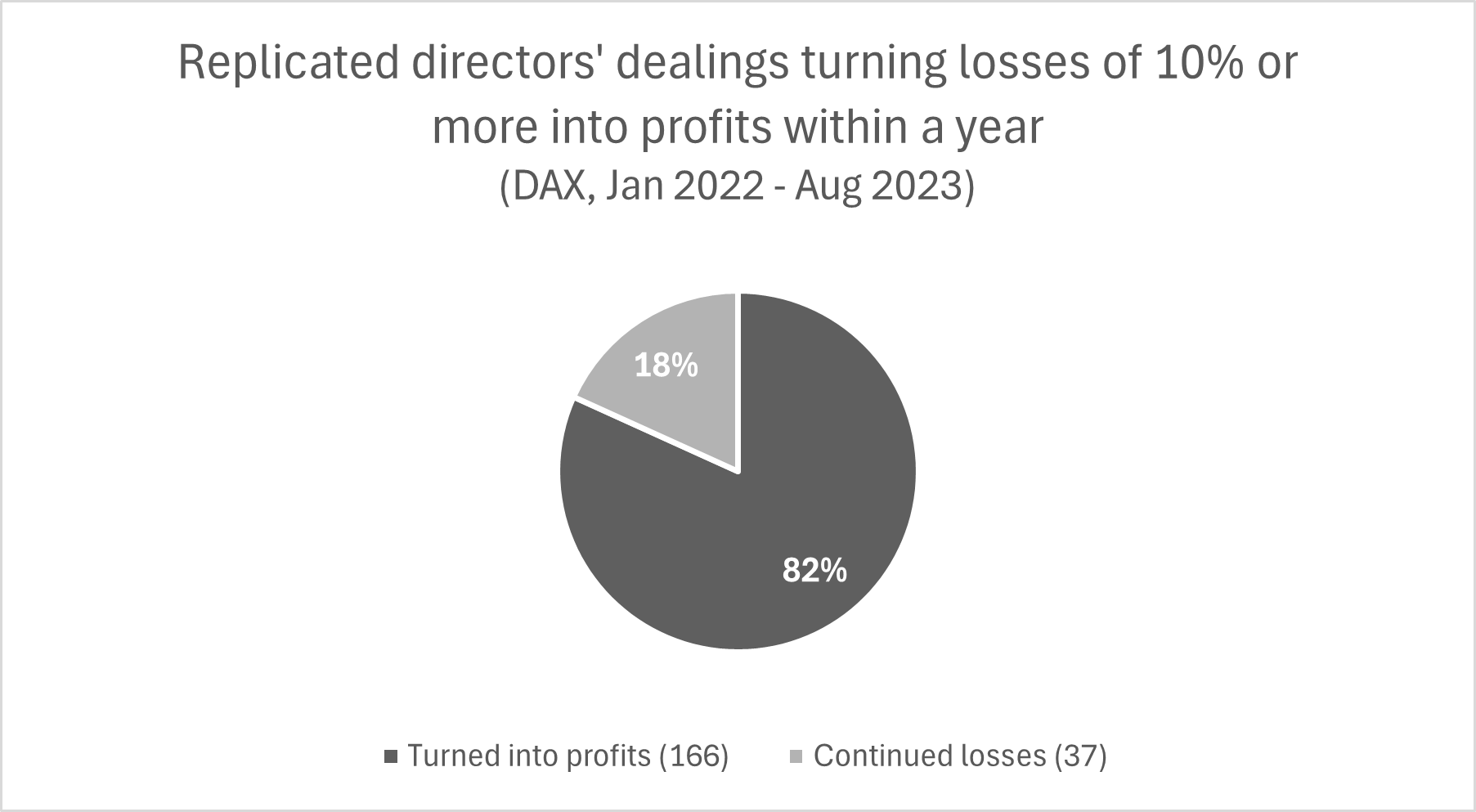

When replicated directors’ dealings trade at negative investment returns – Time for panic-mode?

September 11, 2024

When BMW announced a recall of 1.5 million vehicles due to a brake issue supplied by Continental, the share prices of both companies dropped sharply. Investors who bought these stocks based on the directors’ dealings three months ago may wonder: Is it time to get into panic-mode and sell-off the shares?… Read more

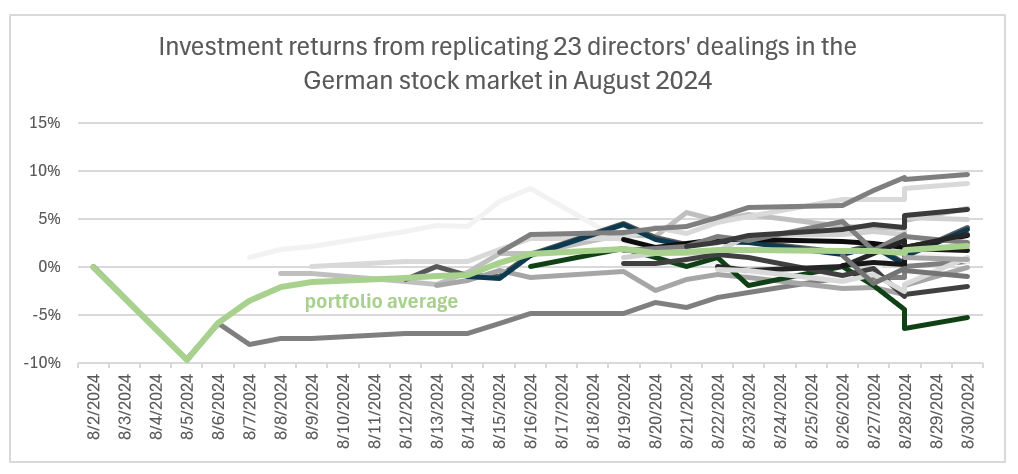

Replicating directors’ dealings in the highly volatile stock market of August 2024

September 4, 2024

August 2024 was a rollercoaster for stocks. At the beginning of the month, stock markets around the globe plunged. By the end of it, many stock market indexes reached or neared all-time highs. This leads to the question: What are the investment returns of replicating director’s dealings in the highly volatile stock market of August 2024?… Read more

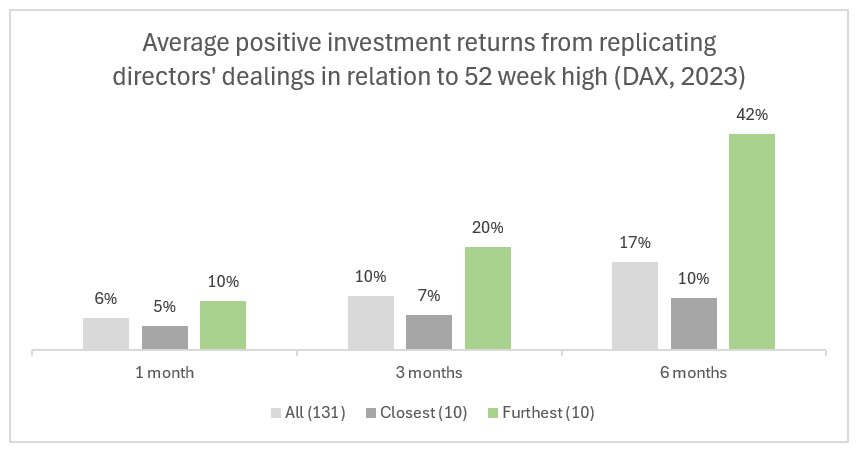

Buy low vs. buy high – Directors’ dealings in the context of the 52 week high

August 28, 2024

Contrarian investors ‘buy low’ which usually implies that their action price is far from the 52 week high. The opposite of ‘buy low’ is ‘buy high’ which relates to stock acquisitions close to the 52 week high. Research suggests that the replication of high buys could lead to superior investment returns… Read more

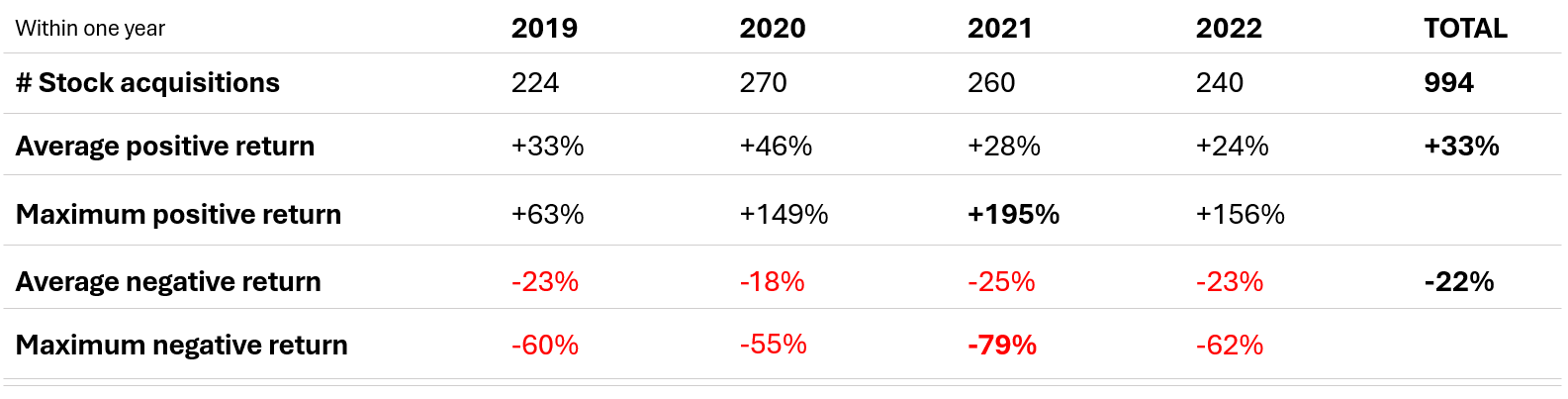

Asymmetric risk reward – Directors and the holy grail

August 21, 2024

Asymmetric risk reward is regarded as the holy grail of investing. Naturally, this makes one think: Does asymmetric risk reward also apply to replicating directors’ dealings? And if yes, how much greater is the reward compared to the risk?… Read more

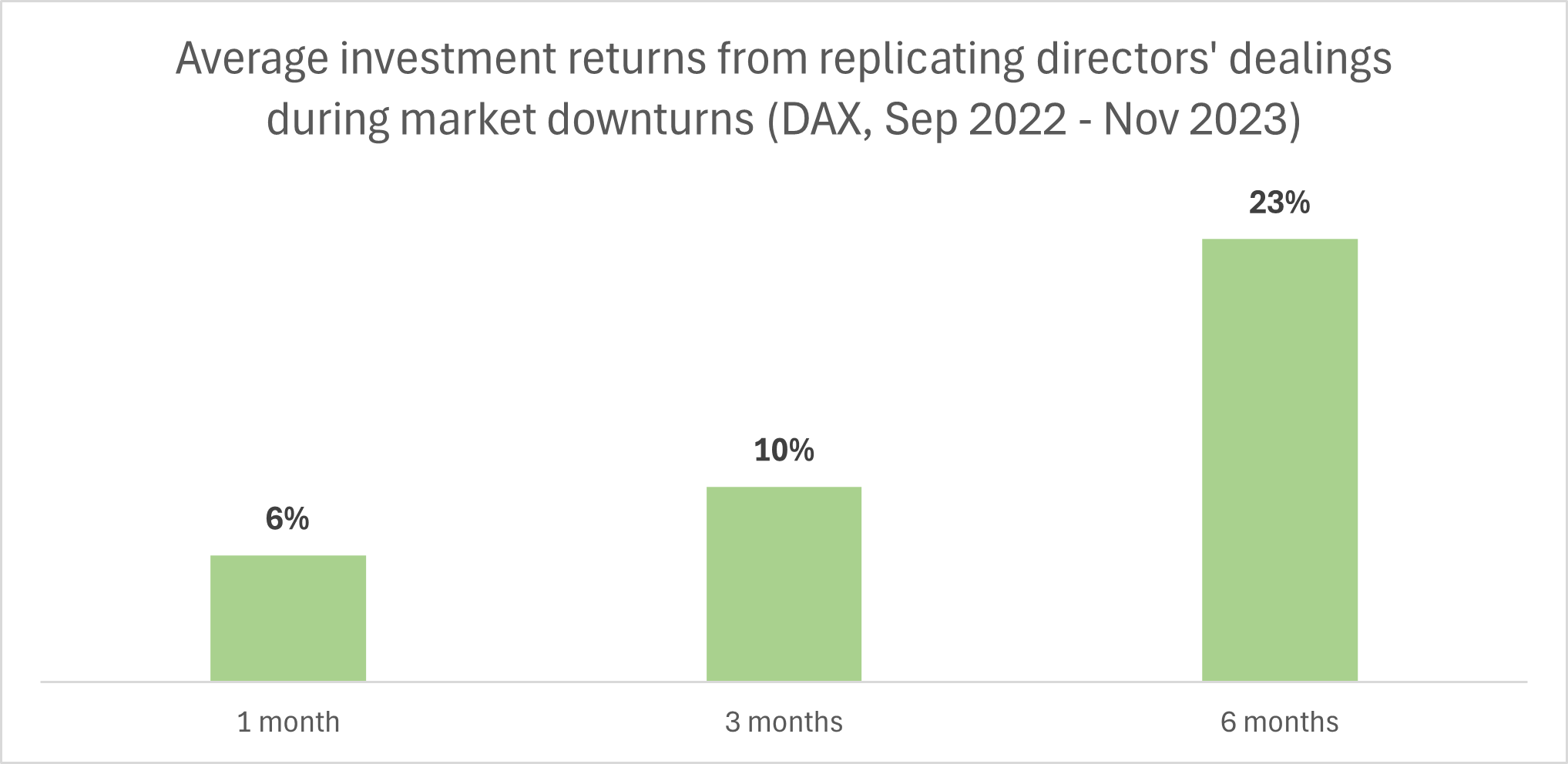

Contrarian investing – Directors trading against the grain

August 14, 2024

Directors often engage in contrarian investing. This means that they trade against the grain. So, when the stock market stumbles, they buy stocks. This leads to the following questions: Do directors trade more when markets plunge and what are the investment returns… Read more

Keep calm during turbulent markets and replicate directors’ dealings

August 7, 2024

Between August 5, 2024 and August 6, 2024, the Japanese stock market index Nikkei saw the biggest daily decline in 37 years followed by the largest ever daily gain. Such market turbulence is rare but can be scary – especially for retail investors. So, the question arises whether replicating directors’ dealings can help to keep calm during turbulent markets… Read more

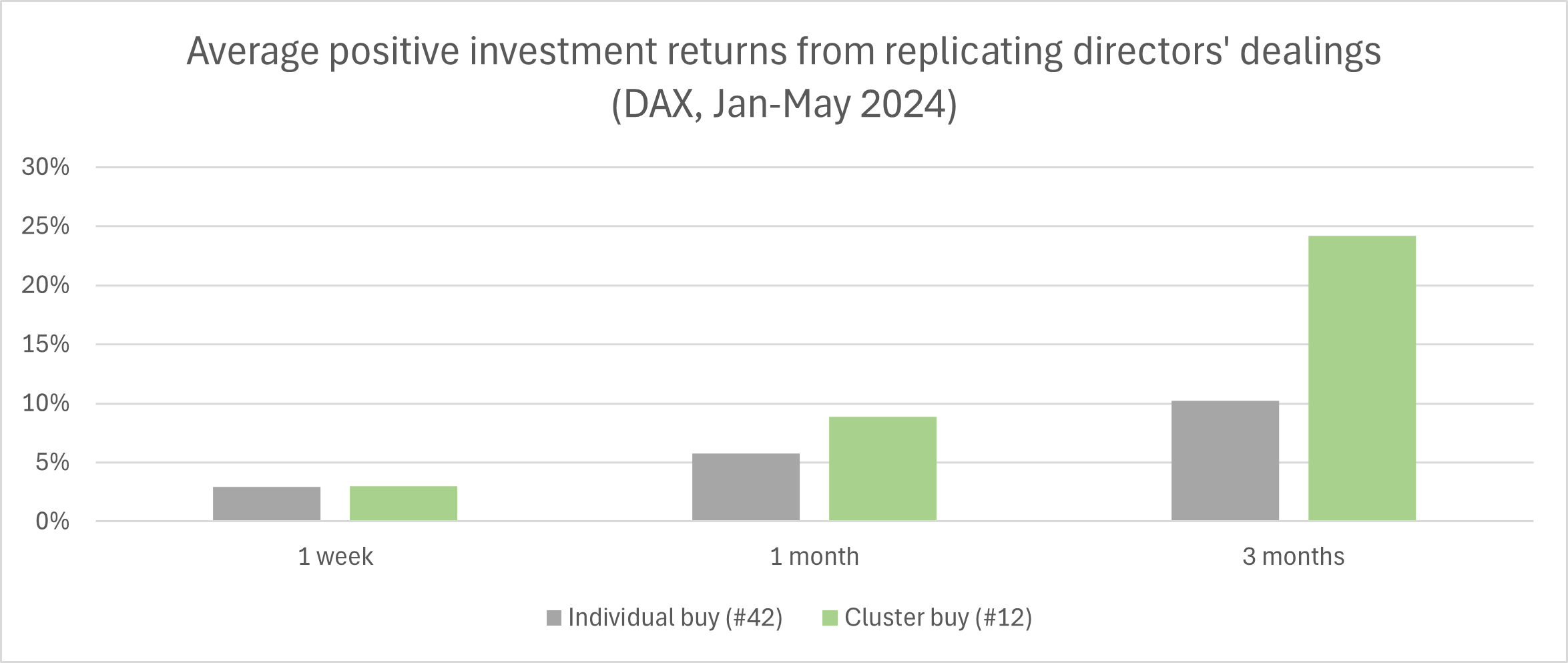

Collective intelligence and investment returns: Cluster vs. individual directors’ dealings

August 2, 2024

We have observed that multiple executives deal on the same day. For example, on August 1, 2024, two board members at Heidelberg Materials bought shares. This can be referred to as a “cluster buy”. So, how do investment returns compare when replicating cluster vs. individual directors’ dealings?… Read more

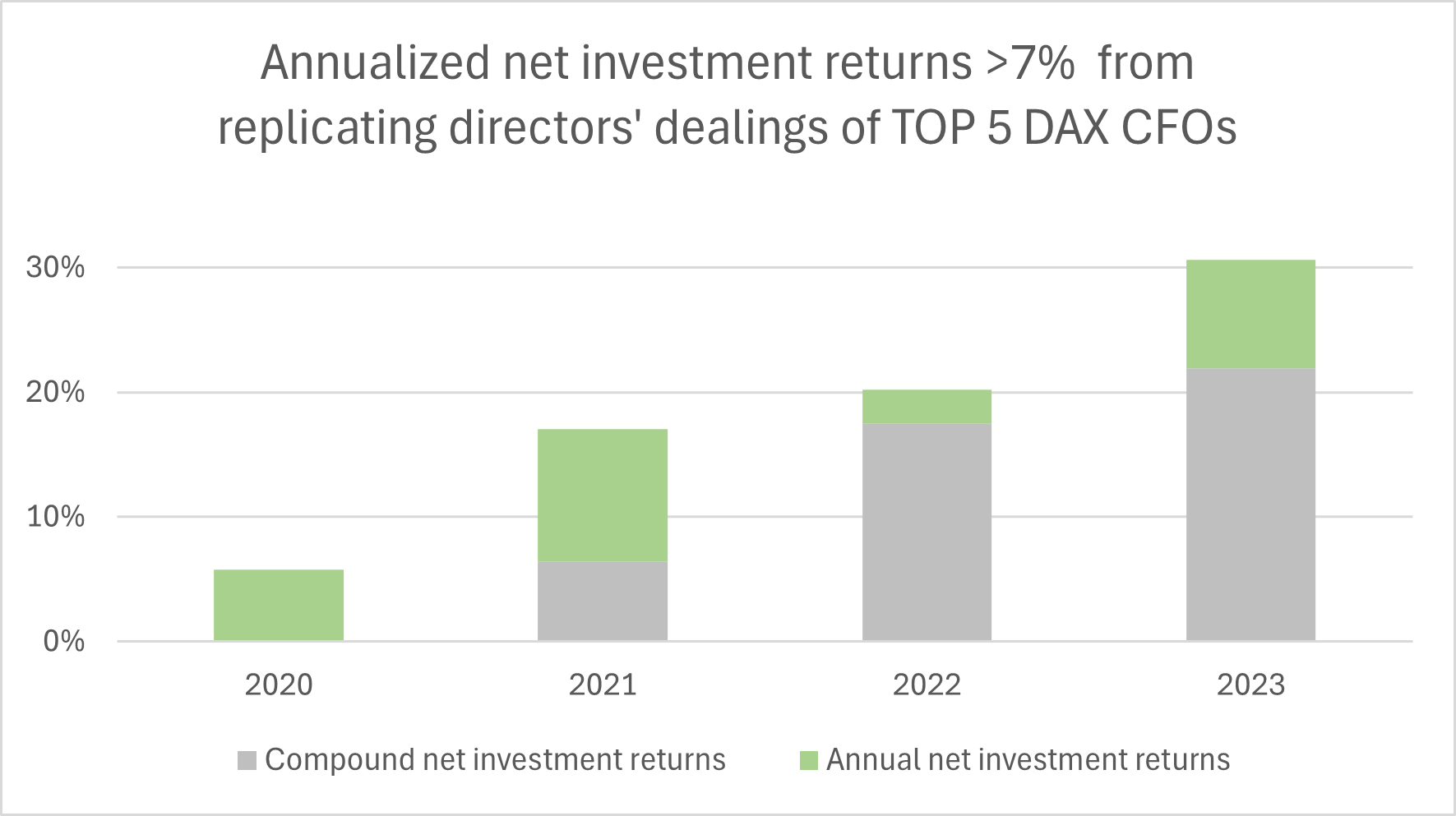

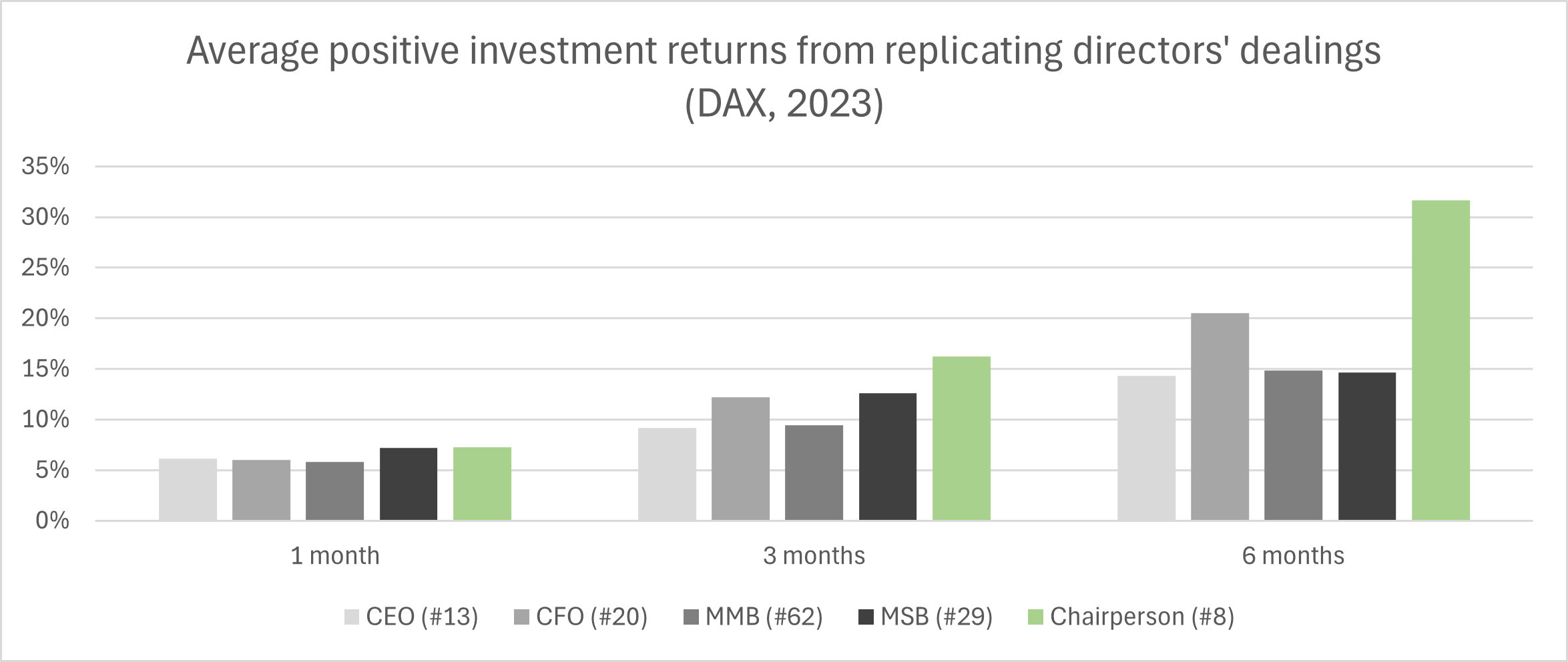

Directors’ dealings are not created equal: Comparing roles and investment returns

July 24, 2024

Director’s dealings are linked to stocks’ future performance and scientific evidence suggests that CFOs yield superior 12-month returns with their transactions in comparison with CEOs. How does this compare for periods of less than 12 months and for other roles such as members of the management and supervisory boards as well as the Chairperson… Read more

Information overload: Finding the right trading signal for stocks

July 17, 2024

Retail investors’ interest in the stock market has increased rapidly in recent years. Access to financial market information has also become broader but more information does not necessarily lead to better results. In light of this information overload it is all the more important to identify the right source of information as trading signal for stocks… Read more

Dip the toes into trading stocks by replicating directors’ dealings

July 10, 2024

Directors’ dealings constitute a scientifically proven trading signal to yield superior investment returns. Understand how to dip the toes into trading stocks by replicating directors’ dealings and which investment returns to expect.… Read more

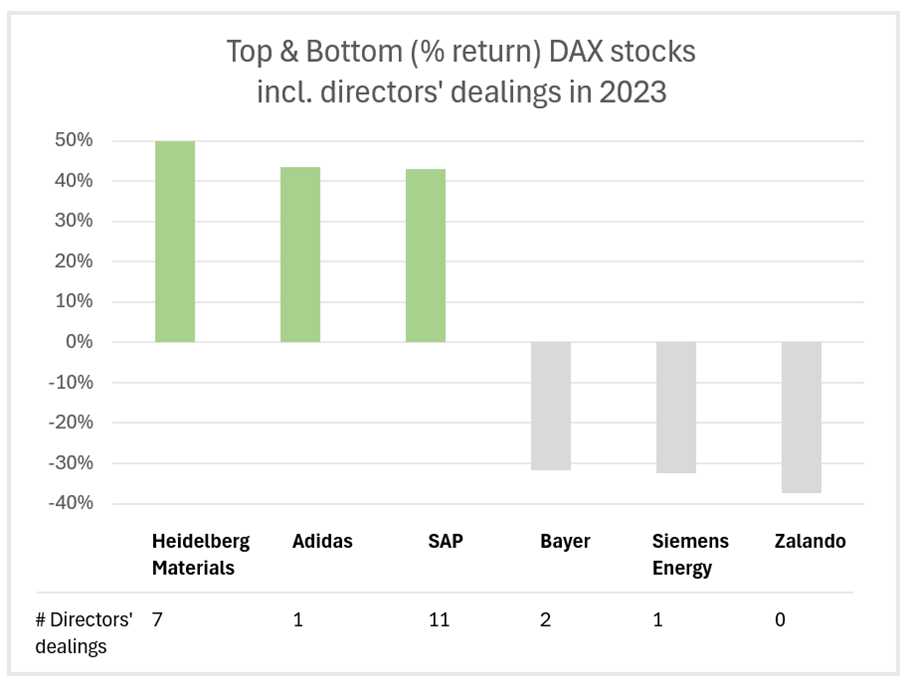

Directors ride the waves of success in the stock market

July 3, 2024

2023 saw a strong performance in the German stock market and managers were actively engaging in directors’ dealings. This leads to the question whether directors ride the waves of success and take advantage of the momentum in the stock market with their directors’ dealings… Read more

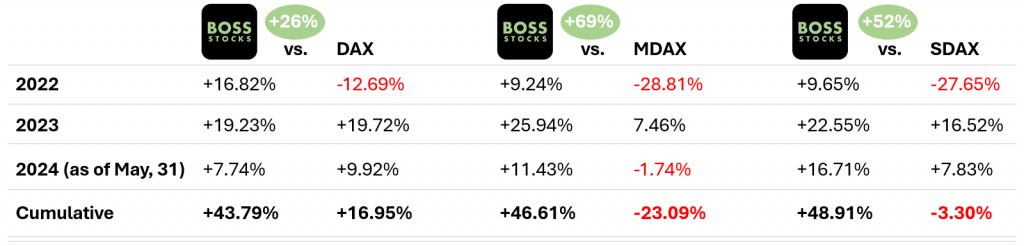

Savings account, ETF or replicating directors’ dealings

June 26, 2024

In 2024, the average interest rate offered by banks in Germany is well below the inflation rate. But investing – through an ETF – in the different German stock market indexes also showed a mixed picture for the first five months of 2024. Naturally, this encourages people to seek alternatives for investing… Read more

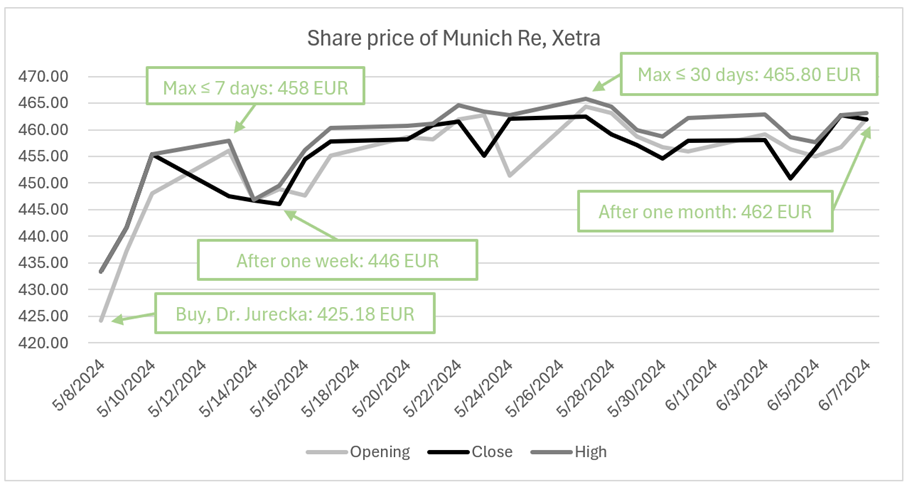

Directors’ dealings signal investment returns

June 19, 2024

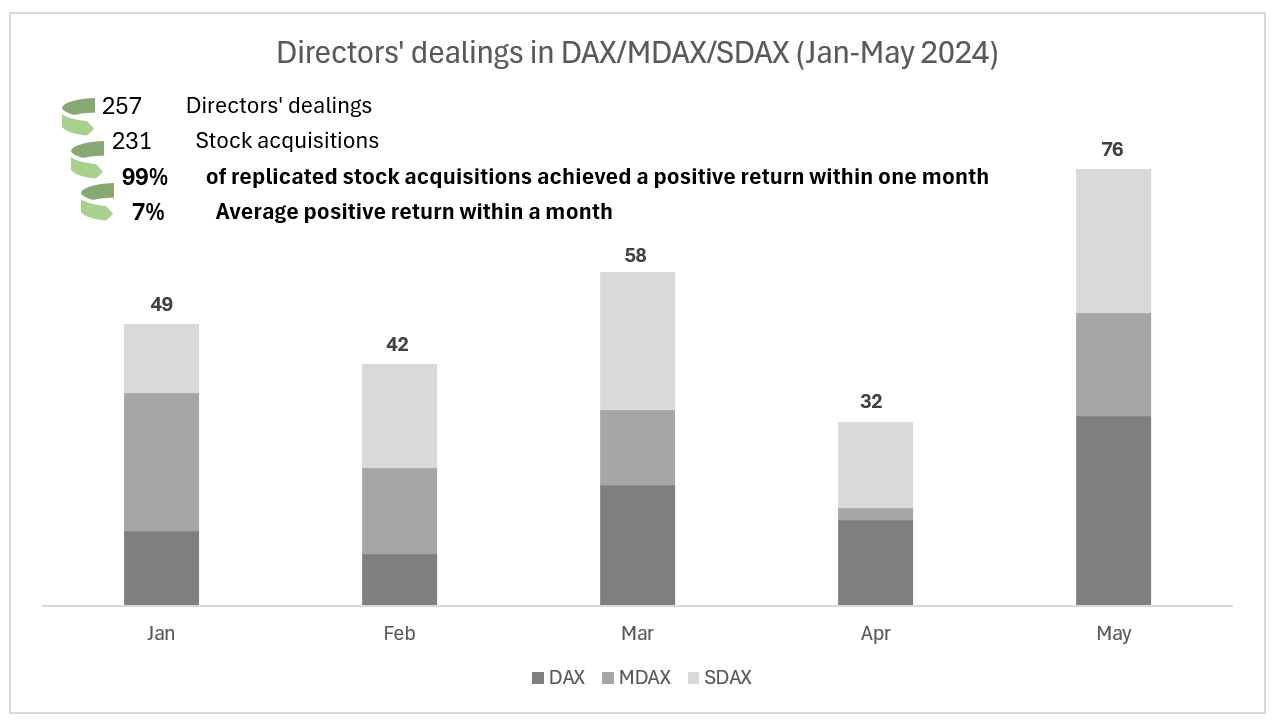

In addition to analysts’ recommendations directors’ dealings or managers’ transactions provide valuable trading signals for investors in the stock market. Executives supposedly know best about the state of their company. In fact, scientific studies confirm that replicating such managers’ transactions can lead to superior investment returns… Read more