Directors’ dealings signal investment returns

June 19, 2024

In addition to analysts’ recommendations directors’ dealings or managers’ transactions provide valuable trading signals for investors to yield investment returns in the stock market. Here are two examples:

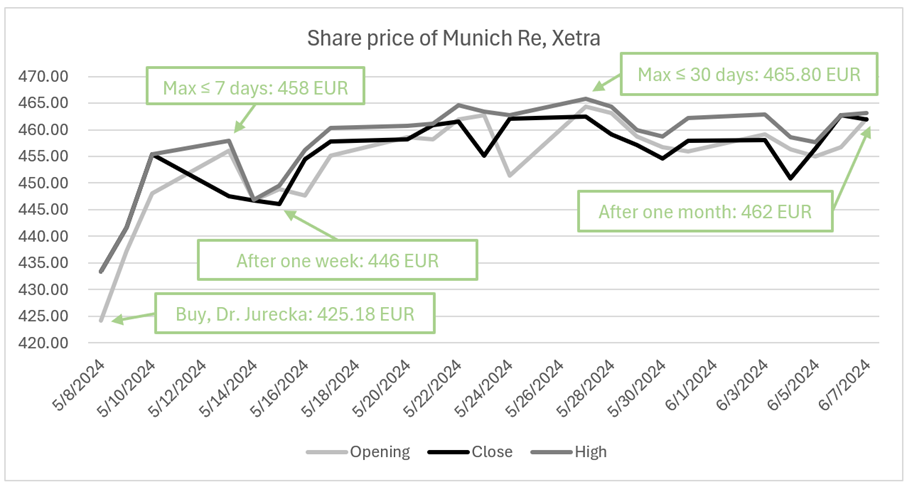

- At the beginning of May 2024, the CFO of Munich Re Dr. Christoph Jurecka bought 160 stocks at a share price of EUR 425.18 (value: EUR 85,036). One week later, the Munich Re share price rose to EUR 446 (+4.90%). A month later, it grew to EUR 462 (+8.66%).

- In early December 2023, SAP co-founder and chairman of the supervisory board Prof. Dr. h.c. mult. Hasso Plattner sold more than 800,000 stocks at a share price of EUR 146.80 (value: EUR >120 million). During the course of the following four weeks, the SAP share price fell to EUR 134.20 (-8.58%).

Executives supposedly know best about the state of their company. This manifests in a strong trading signal when they engage in directors’ dealings. In fact, scientific studies confirm that replicating such managers’ transactions can lead to superior investment returns.1

The difference between directors’ dealings and insider trading

Directors’ dealings or managers’ transactions are private acquisitions/disposals of shares of a stock-listed company through the management and related parties.2 Countries with an obligation to publish managers’ transactions include Australia, Germany, the United Kingdom, Norway, Switzerland and the USA. Further information obligations of listed companies relate to the ad hoc disclosure. Accordingly, all inside information that can significantly influence the price of the respective instrument needs to be provided immediately.3 (Illicit) insider trading refers to “anyone who acts on their inside knowledge and buys or sells securities or amends or cancels an order which was placed previously, for their own benefit or that of anyone else”.4

How to use directors’ dealings as trading signal for investment returns

In Germany, regulation requires stock-listed companies to publish managers’ transactions within a few days, especially via the Federal Financial Supervisory Authority. In the above example at Munich Re, this fell on the day of the director’s dealing on May 8, 2024, which closed at a share price of EUR 433.40. On May 13, 2024, the share price reached a maximum of EUR 458 and the first week after the manager’s transaction ended at EUR 446. The share price formed another maximum of EUR 465.80 on May 27, 2024 and closed the first month after the director’s dealing at EUR 462. So, by replicating this manager’s transaction, an investment return of just under 10% was achievable within a month.

Trade stocks like directors and executives with BOSS STOCKS

Directors’ dealings are a scientifically proven trading signal and the replication can yield superior returns on capital – also in the short-term. BOSS STOCKS is currently developing an investment platform for stocks enabling everyone to replicate directors’ dealings for superior investment returns. Free sign up for the waiting list and to become involved with product testing before product launch.