Directors’ dealings are not created equal: Comparing roles and investment returns

July 24, 2024

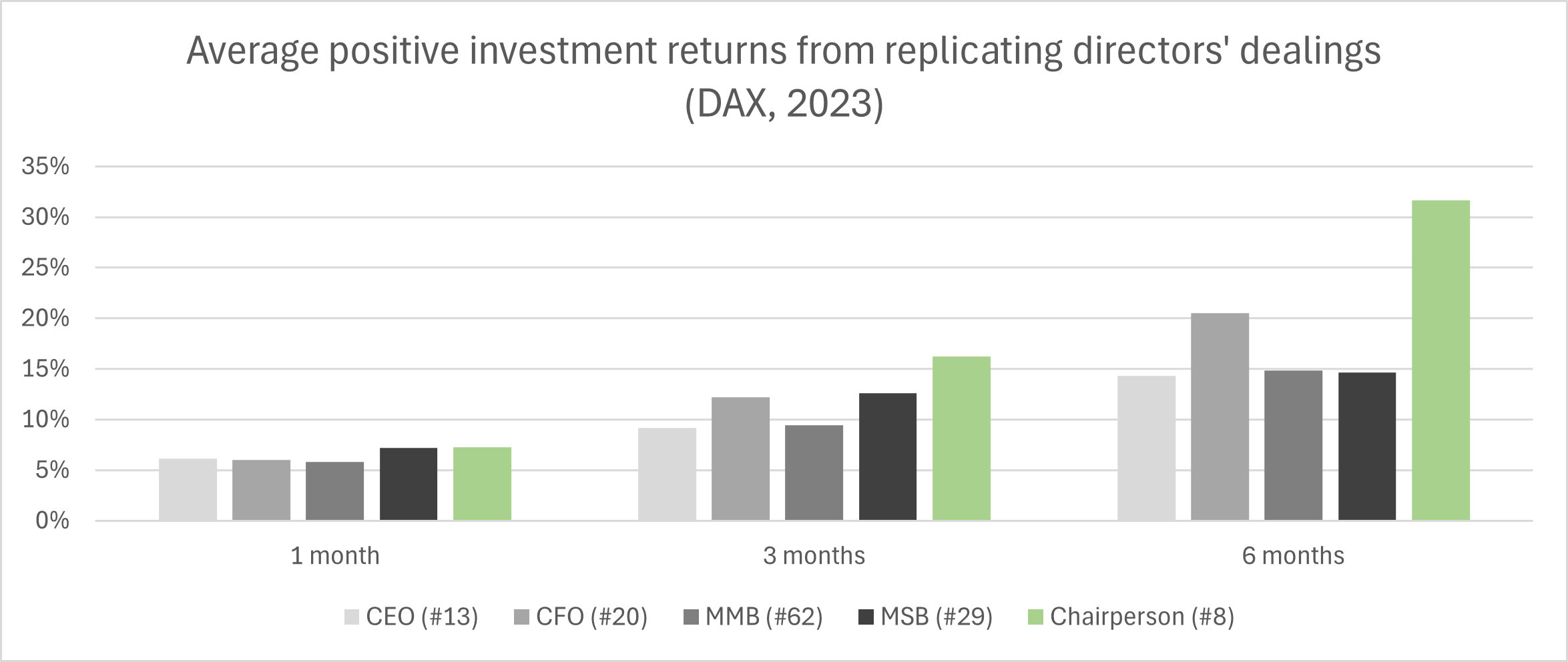

Director’s dealings are linked to stocks’ future performance and research shows that Chief Financial Officers (CFO) yield superior 12-month returns with their transactions compared to Chief Executive Officers (CEO).1 How does this compare for periods of less than 12 months and for other roles such as members of the management and supervisory boards as well as the Chairperson? To answer these questions, BOSS STOCKS investigates how directors’ roles impact investment returns when replicating directors’ dealings. For this purpose, the analysis sheds light on the average positive investment returns from replicating 132 directors’ dealings (stock acquisitions) for periods of one, three and six months. The focal stock market index is the German DAX in 2023.

Comparing roles and investment returns with a surprising result

As a result, the data confirms that the average positive investment returns from replicating the directors’ dealings of CFOs outperform those of CEOs within three and six months. Within one month, the results are comparable. The investment returns based on members of the management board (MMB) are very similar to the CEOs’. Notably, the stocks profits linked to members of the supervisory board (MSB) are slightly superior within one and three months. In fact, the most surprising observation relates to the Chairperson that outperforms all other groups across all periods. In the sample, this group comes with the least cases and, thus, individual cases might have a stronger influence on the average.

Examples of directors’ dealings with strong investment returns

- In a previous blog post, we compared the managers’ transactions for the top and bottom DAX stocks in 2023. Siemens Energy was at the bottom and showed only one director’s dealing which relates to the Chairperson, Joe Kaeser. He bought shares in mid-November after the share price had started to bounce back from a decline over multiple months. Replicating this director’s dealing led to investment returns of 12%/35%/138% within one/three/six months.

- The second highest investment return of 62% within six months relates to Karin Rådström, a MMB at Daimler Truck. Replicating her manager’s transaction outperformed the averages of all groups for all periods of observation.

- In the aforementioned blog post, Heidelberg Materials was portrayed as one of the DAX top stocks with more than a handful of directors’ dealings in 2023. Two of which related to its CFO, René Aldach. Replicating those directors’ dealings yielded investment returns north of 50% within six months.

Discover the directors’ dealings for superior investment returns with

BOSS STOCKS

The results produce two key takeaways. Firstly, replicating managers’ transactions leads – on average – to strong investment returns. Secondly, the investment returns differ between roles and individual executives. BOSS STOCKS helps you replicate such directors’ dealings. Free sign up to discover the directors’ dealings that can help you yield superior investment returns.