Directors’ dealings and the 200-day simple moving average

October 23, 2024

In an earlier blog post, we showed that linking managers’ transactions with selected technical analysis indicators improves replication performance especially in timeframes of a few weeks to a few months. The 200-day simple moving average (SMA) is used to evaluate long-term market trends and the stock price above/below is considered a positive/negative signal.1 Consequently, this leads to the question: Can the combination of directors’ dealings with the 200-day SMA improve replication performance in the longer term? To answer this question BOSS STOCKS evaluated 120+ directors’ dealings (stock acquisitions) in the German DAX between January and mid-October 2023.

Combining directors’ dealings with the 200-day SMA boosts replication performance in the longer term

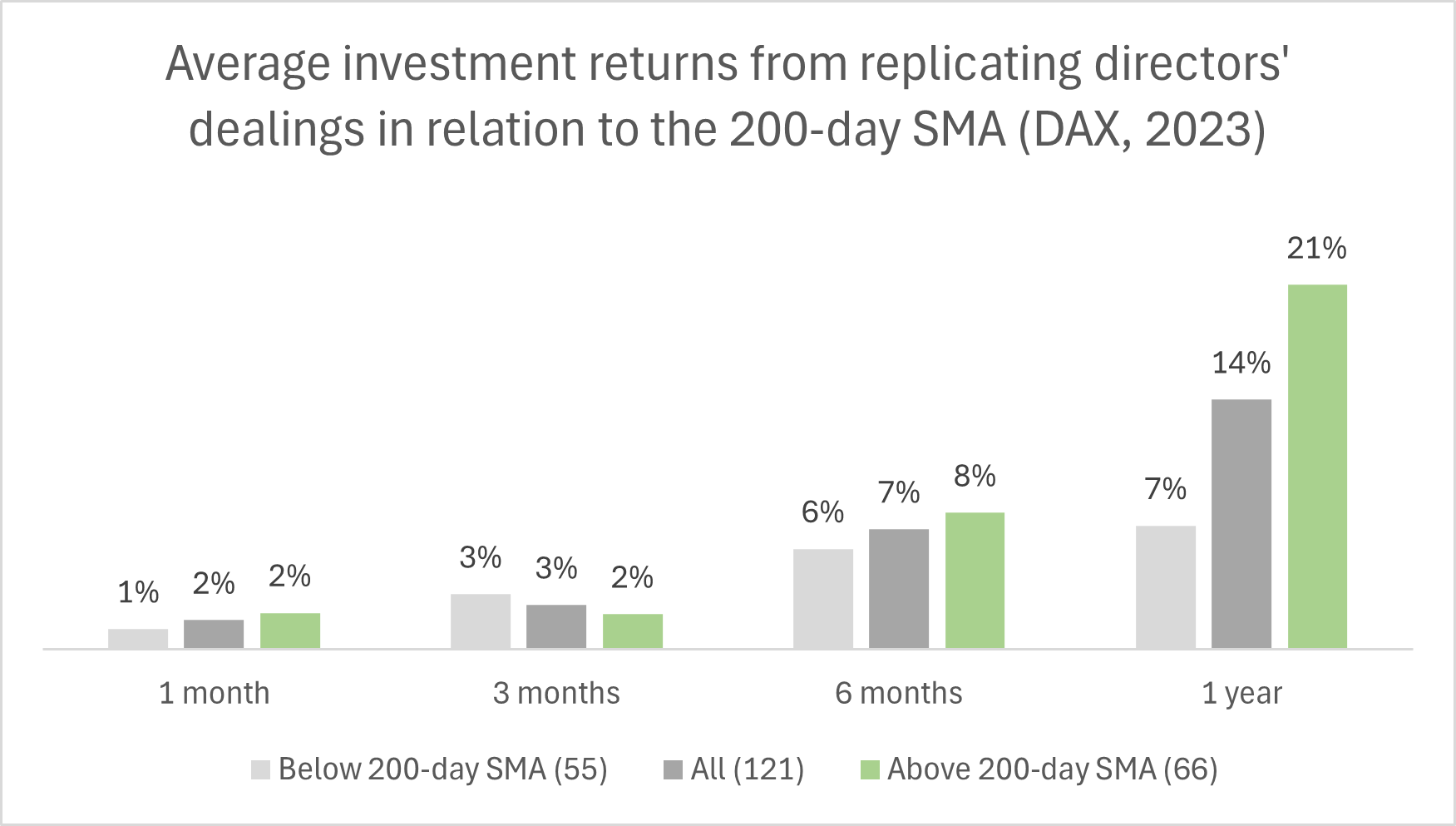

- The results show that replicating directors’ dealings is successful even with a simple strategy: Buying stocks for the opening share price of the day that follows the day of the release and holding for 1 month/3 months/6 months/1 year led to average investment returns of 2%/3%/7%/14%.

- Focusing on managers’ transactions above the 200-day SMA further bettered the investment returns for 1, 6 and 12 months. Finally, the increase (+7 p.p.) is largest for 1 year. Moreover, the only timeframe for which the combination does not lead to improved investment returns is three months.

- Across all timeframes, the variation of values around their mean is lower above the 200-day SMA. This is in line with a previous blog post. The replication of managers’ transactions above the 200-day SMA might be more suited for risk-averse investors.

- The highest investment returns north of 100% over a period of 12 months are all attributed to directors of Rheinmetall.

Discover directors’ dealings for strong investment returns with BOSS STOCKS

The results suggest that combining directors’ dealings with the 200-day SMA can improve replication performance in the longer term. BOSS STOCKS helps you link managers’ transactions with SMAs. Free sign up to test the product before market launch.