Replicating directors’ dealings in the highly volatile stock market of August 2024

September 4, 2024

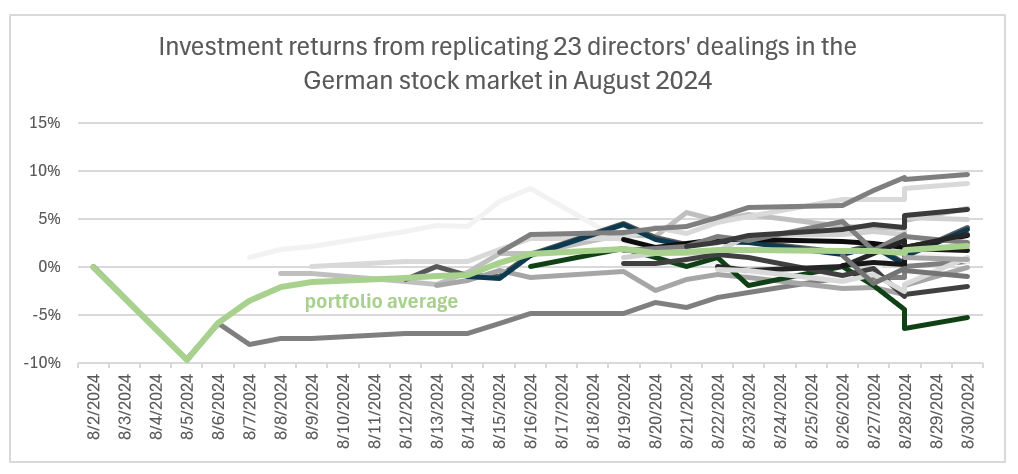

August 2024 was a rollercoaster for stocks. On August 5, 2024, stock markets around the globe plunged. By the end of the month, many stock market indexes reached or neared all-time highs. In an earlier blog post, we showed that directors do not deal more when markets decline but replicating those that do engage in managers’ transactions was a successful strategy. Naturally, this leads to the question: What are the investment returns of replicating directors’ dealings in the highly volatile stock market of August 2024? To answer this question, BOSS STOCKS assessed the 23 directors’ dealings in the German stock market indexes.

Below average number of directors’ dealings delivers strong investment returns in volatile stock markets

- Compared to the 2023 average of 2.5 directors’ dealings per trading day, directors’ dealings averaged only about one manager’s transactions per trading day in August 2024. This might also be attributed to holiday season. The busiest day was August 15, 2024 with five directors’ dealings. The most active group were CEOs accounting for about 30% of all managers’ transactions.

- Buying stocks for the opening share price of the day that follows the day of the release and holding until August 30, 2024 led to an average portfolio performance of +2.17%. 74%/26% of the stocks in the portfolio had positive/negative investment returns. The highest investment return of +9.66% is associated with a director’s dealing of Michael Kerner of Munich Re. The lowest investment return of -5.24% is related to the managers’ transactions of both management board members at Ceconomy.

- In addition, the asymmetric risk reward could be further optimized by focusing only on the seven managers’ transactions associated with companies in the DAX. As a result, this strategy yielded an average portfolio performance of 5.37% in which 100% of stocks had a positive investment return as per August 30, 2024.

BOSS STOCKS helps you find the “right executives” and their directors’ dealings

Replicating directors’ dealings in volatile markets seems to be a promising strategy with a favorable risk reward asymmetry. Consequently, BOSS STOCKS can help you identify the right executives and their directors’ dealings. Free sign up to test the product before market launch.