Contrarian investing – Directors trading against the grain

August 14, 2024

Directors often engage in contrarian investing. This means that they trade against the grain.1 So, when the stock market stumbles, they buy stocks. For example, on August 5, 2024, many stock markets globally plunged. On this day, the CEO of Hensoldt, Oliver Dörre, bought own shares. This observation triggers the following two questions:

- Do directors trade more when markets plunge?

- What are the investment returns from replicating directors’ dealings in a market downturn?

To answer these questions, BOSS STOCKS focused on the German stock market index DAX to evaluate the directors’ dealings in a market downturn and up to two weeks after for the last five market downturns (i.e., decline of 5% or more over four weeks).

Few directors are trading against the grain but they are generally successful with contrarian investing

- The results suggest that directors do not trade more when markets plunge. Based on the specified timeframe above, there were 72 trading days in which 24 directors’ dealings were recorded. In a previous blog post, we pointed out that there were on average 2.5 dealings per trading day across the German stock market indexes in 2023. Accordingly, directors traded less than usual during the last five market downturns.

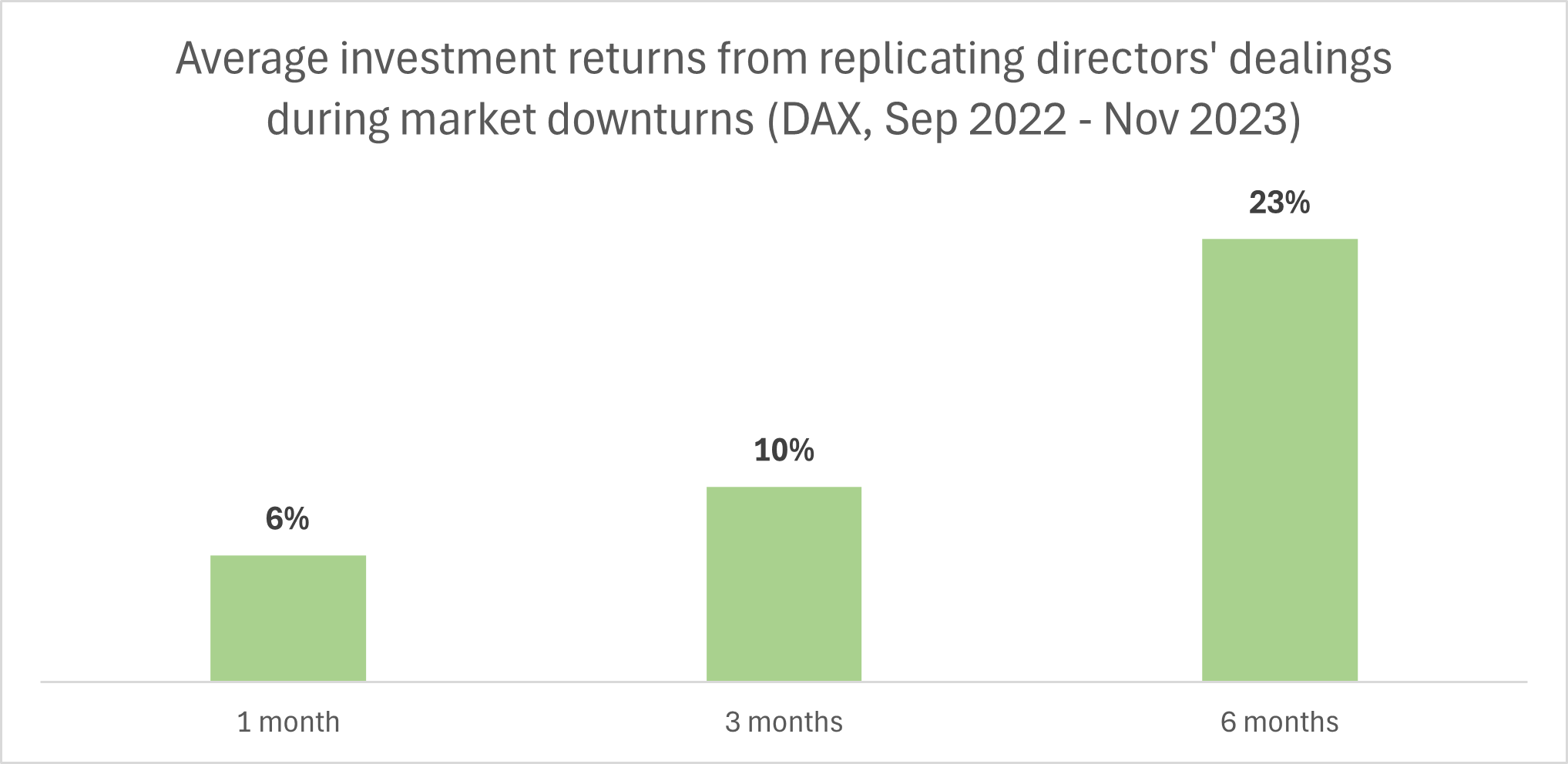

- Replicating the 24 managers’ transactions was highly successful even with a simple strategy. Buying stocks for the opening share price of the day that follows the day of the release and holding for 1/3/6 months led to average investment returns of 6%/10%/23%.

BOSS STOCKS helps you find the “right executives” and their directors’ dealings

To sum it up: Replicating directors’ dealings during market downturns seems like a good idea but not all of them yield positive investment returns. In the above example, the ratio of positive to negative investment returns across periods is slightly greater than 2:1. BOSS STOCKS helps you identify the right executives to replicate their directors’ dealings. Free sign up to test the product before market launch.