Savings account, ETF or replicating directors’ dealings – Comparing investment returns across years

June 26, 2024

In 2024, the average interest on a savings account (“Tagesgeld”) across banks in Germany is 1.75%.1 In comparison, in 35 years of the German stock market index DAX, the average return was above 7% per year.2 This may suggest that investing in the stock market is favorable compared to a savings account. It also prompts the question how investment returns compare across years.

Investment returns in the light of inflation

Between January and May 2024, inflation was greater than 2% in Germany.3 This exceeds the above mentioned interest rate on a savings account and it implies that savings have lost value over time (i.e., the same amount of money buys less goods). Naturally, this encourages people to seek alternatives for investing. Investing – through an ETF – in the different German stock market indexes, however, showed a mixed picture for the first five months of 2024:

- DAX (i.e., 40 largest companies by stock market turnover and market capitalization): +9.92%

- MDAX (i.e., 50 companies ranking below the companies in DAX): -1.74%

- SDAX (i.e., 70 companies ranking below the companies in MDAX): +7.83%

Replicating directors’ dealings yields consistently positive and superior investment returns

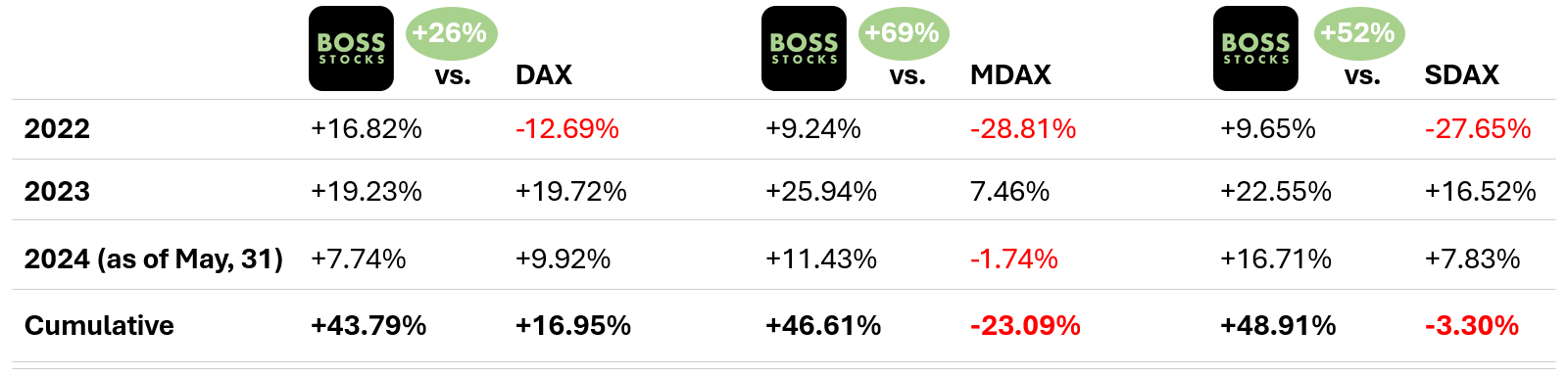

Directors’ dealings are a scientifically proven trading signal and the replication can yield superior investment returns. BOSS STOCKS ran simulations to compare the return on investments based on directors’ dealings versus leading stock market indexes across years. The selected directors’ dealings are based on directors’ previous performance (i.e., strong track record across dealings), same amount for each investment (e.g., 1,000 EUR) and no parallel investments.

The results show that BOSS STOCKS‘ simulations not only yield consistently positive investment returns but also outperform MDAX and SDAX every year. Ultimately, this manifests in superior cumulative investment returns versus all indexes. Notably, the same holds in multi-year performance comparisons with indexes such as MSCI World, NASDAQ100 and S&P500.

Explore BOSS STOCKS ahead of launch

BOSS STOCKS is currently developing an investment platform for stocks enabling everyone to replicate directors’ dealings for superior investment returns. Free sign up for the waiting list and to experience the product ahead of launch.