Buy low vs. buy high – Directors’ dealings in the context of the 52 week high

August 28, 2024

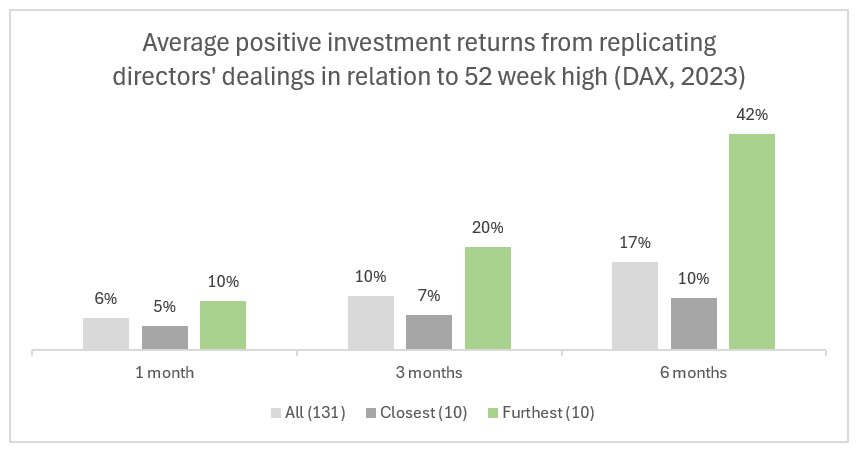

A previous blog post shed light on directors as contrarian investors and that replicating their directors’ dealings is rewarding. Contrarian investors ‘buy low’ which usually implies that their action price is far from the 52 week high. The opposite of ‘buy low’ is ‘buy high’ which relates to stock acquisitions close to the 52 week high. Research suggests that the replication of high buys could lead to superior investment returns.1 Therefore, BOSS STOCKS analyzed the average positive investment returns within one/three/six months in relation to the 52 week high of 131 directors’ dealings (stock acquisitions) in the German DAX in 2023.

Directors’ dealings far from 52 week high (i.e., low buys) with highest average positive investment returns

- Directors’ dealings that are furthest from 52 week high (i.e., low buys) yield the highest average positive investment returns. These amount to 10%/20%/42% within one/three/six months. Also, the positive investment returns for all managers’ transactions outperform those that are closest to the 52 week high (i.e., high buys).

- It does not surprise that of the 10 directors’ dealings with the highest average positive investment returns within 6 months, 3 relate to executives’ low buys. The leading one belongs to a manager’s transaction of Joe Kaeser at Siemens Energy. Replicating this director’s dealing led to investment returns of 12%/35%/138% within one/three/six months.

- The analysis also shows that the standard deviation which describes the amount of variation of the values around its mean is much lower for high buys compared to low buys. It implies that the replication of high buys might be more suited for risk-averse investors. This is due to the lower volatility and hence lower probability of incurring a loss.

BOSS STOCKS helps you find the “right executives” and their directors’dealings

Replicating directors’ dealings to buy low appears to be a suitable strategy to maximize investment returns while buy high seems appropriate to minimize risk. BOSS STOCKS helps you identify the right executives associated with the respective cases and their directors’ dealings. Free sign up to test the product before market launch.