Asymmetric risk reward – Directors and the holy grail

August 21, 2024

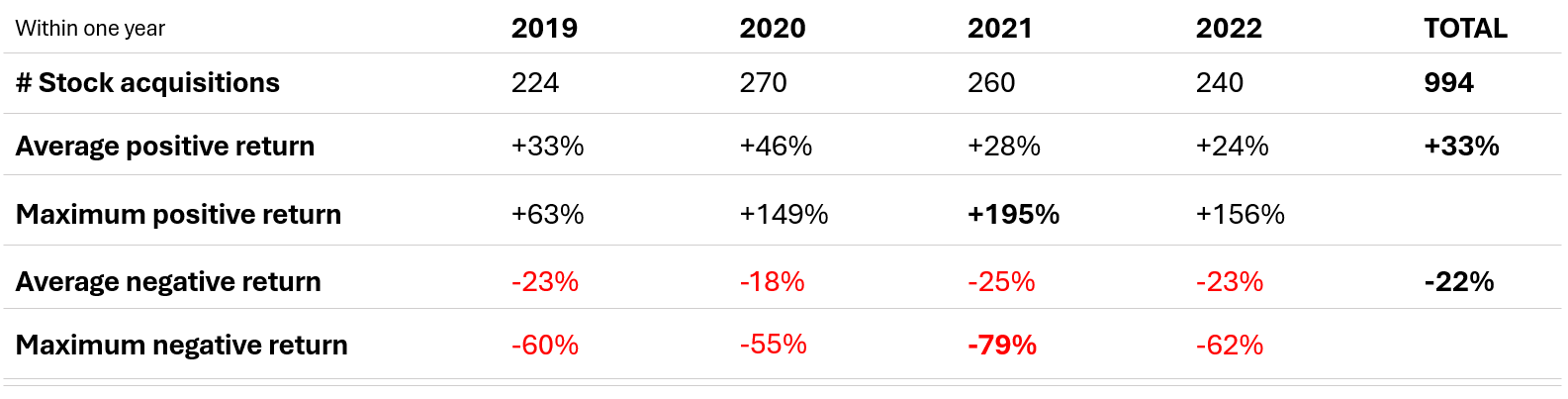

Asymmetric risk reward is regarded as the holy grail of investing. It implies that potential gains from an investment are greater than the potential losses, and star investors have pursued such asymmetric bets.1 Naturally, this makes one think: Does asymmetric risk reward also apply to replicating directors’ dealings? And if yes, how much greater is the reward compared to the risk? To answer these questions, BOSS STOCKS assessed the investment returns within one year of nearly 1,000 directors’ dealings (stock acquisitions) in the Prime Standard of the German stock market between 2019 and 2022.

Directors’ dealings serve as trading signal for asymmetric risk reward

- The maximum positive investment return is +195% and the maximum negative investment return equals -79%. So, when investing 100 EUR, risking a loss of 79 EUR comes at a potential reward of 195 EUR. It implies that the upside reward is up to 2.5 times greater than the downside risk.

- The average positive investment return equals +33% while the average negative investment return is -22%. So, when an investor decides to replicate all directors’ dealings the upside reward is significantly higher than the downside risk. Consequently, a success rate of 40% allows to break even.

- Many of the largest positive investment returns of >+100% are related to stock acquisitions right after the market crash linked with COVID-19 in March 2020 and the subsequent market recovery. The largest negative investment returns of <-50% are more equally spread across companies and years. Executives associated with both relate to Heidelberg Materials and MTU Aero Engines.

BOSS STOCKS helps you find the “right executives” and their directors’ dealings

Asymmetric risk reward applies when replicating directors’ dealings. It holds for averages and especially for individual cases with maximum investment returns. BOSS STOCKS helps you identify the right executives associated with those cases and their directors’ dealings. Free sign up to test the product before market launch.