2024 in review: Directors’ dealings exceeded index performance

January 2, 2025

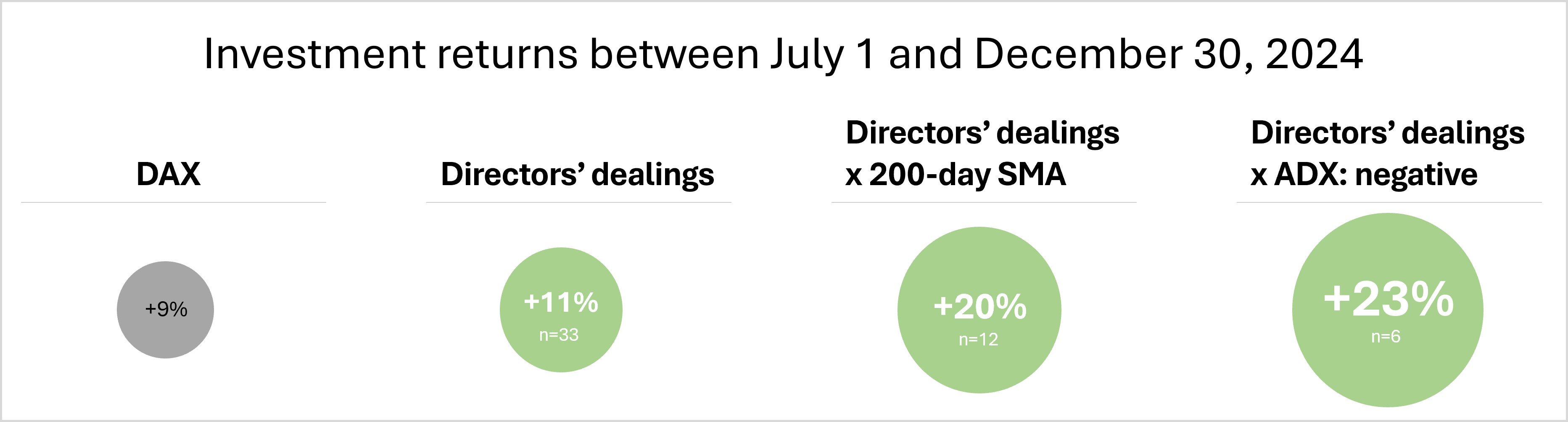

2024 was a good year at the stock market with positive returns across many indexes and countries. BOSS STOCKS was introduced in Germany mid-year to help replicate directors’ dealings for superior investment returns with stocks. The underlying principle is to “cut through the noise” and condense the vast amount of stocks news into a single proven trading signal – directors’ dealings. Fast forward six months, the change of years seems a good time to take stock and review how managers’ transactions held up against the index performance of the German DAX. BOSS STOCKS drew on 33 directors’ dealings (stock acquisitions) in the German DAX which were published and shared in the second half of 2024.

Director’s dealings yielded double-digit investment returns and surpassed index performance of the DAX

- Between July 1 and December 30, the German DAX rose by more than +9%. So, investing 1,000 EUR at the beginning of July would have yielded nearly 92 EUR before taxation at the end of December.

- Investing 1,000 EUR to replicate the 33 managers’ transactions would have yielded almost 112 EUR before taxation. This equals a margin of more than +11% which is nearly 2 percentage points superior to the DAX’s return.

- A previous blog post showed that combining directors’ dealings with the 200-day simple moving average (SMA) boosts replication performance in the longer term. Twelve of the 33 managers’ transactions were above the 200-day SMA. Investing 1,000 EUR into them would have resulted in close to 200 EUR investment returns before taxation. This equals a margin of nearly +20% which is more than ten percentage points superior to the DAX’s return.

- Another blog post illustrated that combining directors’ dealings with negative attributes of the average directional index (ADX) increases replication performance. Six of the 33 managers’ transactions had a negative ADX. Investing 1,000 EUR into them would have yielded nearly 233 EUR before taxation. This equals a margin of more than +23% which is almost 15 percentage points superior to the DAX’s return. Matching directors’ dealings with the relative strength index’s (RSI) oversold attribute also led to positive investment returns.

Discover the directors’ dealings for superior investment returns with BOSS STOCKS

The results show that BOSS STOCKS can help you replicate directors’ dealings for superior investment returns with stocks. Combining manager’s transactions with selected technical analysis indicators improves the replication performance further.